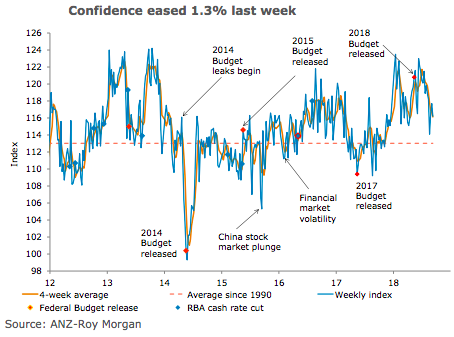

Australia’s ANZ-Roy Morgan consumer confidence eased 1.3 percent last week, after two straight weekly rises. Improvements in sentiment toward future finances and current economic conditions were not strong enough to offset falls in the remaining sub-indices.

Households’ perception of current financial conditions fell 4.8 percent last week, more than reversing a cumulative 1.7 percent gain over the previous two weeks. Meanwhile, sentiment towards future financial conditions rose 2.1 percent, its third straight weekly increase.

Encouragingly, households’ assessment of current economic conditions bounced 2.1 percent, entirely reversing the prior week’s fall. Consumers were less optimistic about future economic conditions, however. Their assessment fell 3.5 percent to 111.5 (versus a long term average of 113.9).

The 'time to buy a household item' sub-index fell 2.3 percent last week, only partially reversing the sharp 5.2 percent rise in the prior week. Four-week moving average inflation expectations were unchanged at 4.3 percent, though the weekly value dipped to 4.1 percent.

"We expect a solid jobs report on Thursday, which should provide some support for confidence in the near term. That said, geopolitical developments continue to evolve and have the potential to weigh on the outlook of consumers," said David Plank, Head of Australian Economics, ANZ Research.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out