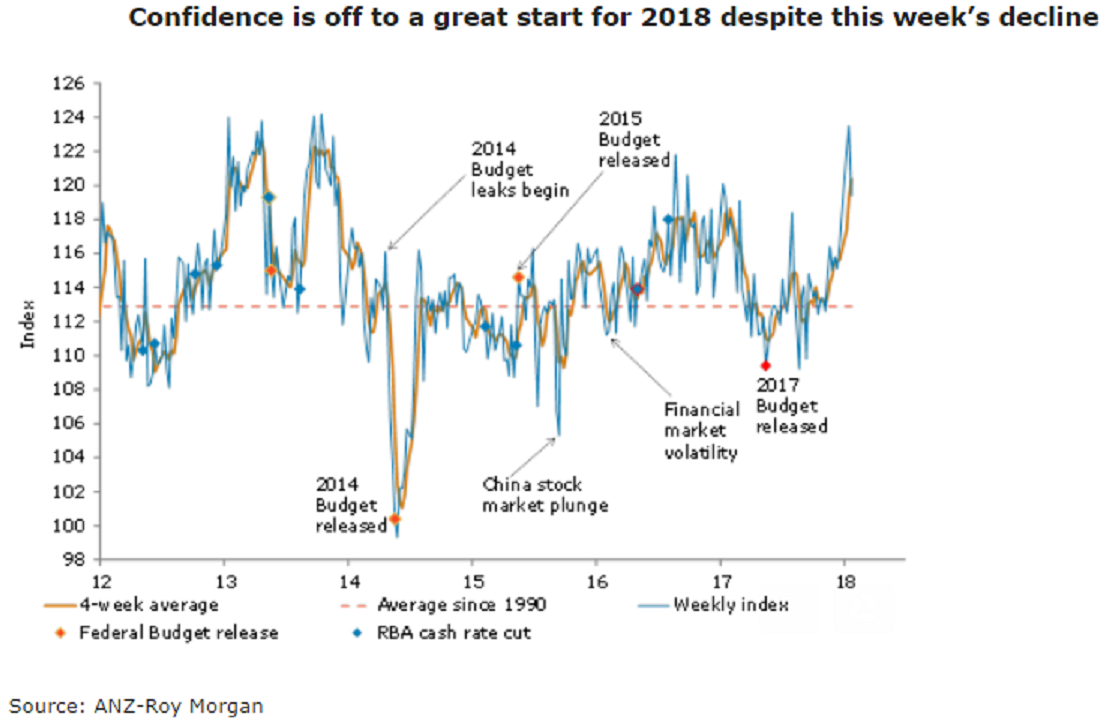

Australia’s ANZ-Roy Morgan Australian consumer confidence fell 3.3 percent last week following three consecutive strong reports. The fall was broad-based, with views towards current finances leading the pullback.

The current finances sub-index fell a sharp 9.1 percent to 104.7, partially unwinding gains over the previous three weeks. In comparison, views towards future finances fell a more modest 2.2 percent, following a 0.2 percent decline in the week prior. Despite the weekly falls, both sub-indices sit above their long-term average.

Households’ pessimism also extended towards the economic outlook. Views on current and future economic conditions dipped 3.6 percent and 1.3 percent respectively, though both sub-indices remain elevated compared to recent lows.

Sentiment around the ‘time to buy a household item’ slipped 1 percent last week following a 7.9 percent rise over the preceding two weeks. Four-week moving average inflation expectations edged up by 0.1 percent to 4.6 percent.

"Looking past the weekly volatility, we expect sentiment to remain supported by a strong labor market and a solid outlook for economic activity in 2018," said David Plank, Head of Australian Economics, ANZ Research.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election