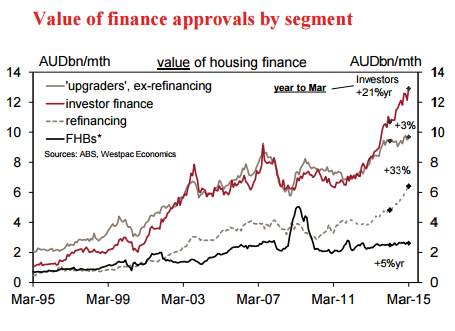

The 1.6% rise in owner occupier finance approvals in March was almost entirely due to a surge in refinancing (+4%mth, 21%yr) with loans ex refi up just 0.3%mth, and down 3%yr. Construction-related approvals were soft but the value of loans to investors jumped 6.4% (clearly no impact of 'macroprudential pressure' on this segment so far).

Industry data suggests owner-occupier approvals were down a touch in April, a somewhat surprising result given the February rate cut and strong auction activity. This likely reflects regional disparities with auctions only a meaningful indicator for Sydney and Melbourne.

Approvals are expected to show a 1.5% dip. There will again be keen interest in the investor numbers which may start to show the impact of regulatory efforts to contain credit growth in this segment

Australia - Housing finance to show a dip in April

Tuesday, June 9, 2015 12:57 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed