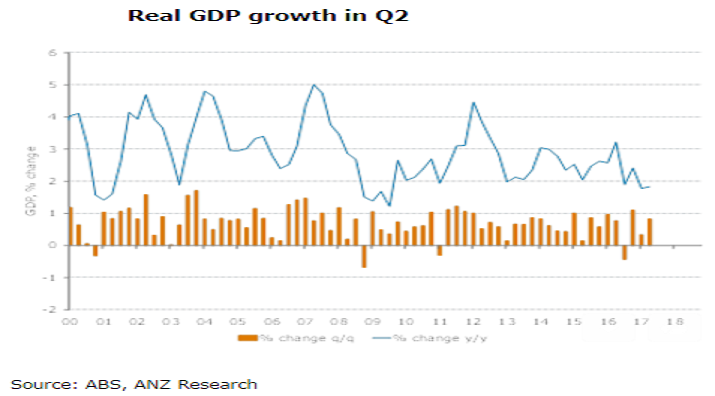

Australia’s gross domestic product (GDP) for the second quarter of this year rose a solid 0.8 percent q/q in Q2, leaving annual growth unchanged at 1.8 percent. Growth was supported by a strong gain in public spending, moderate household consumption and a small contribution from net exports. However, wages and inflation measures remain soft.

The public sector was the main driver of growth, with a strong rise in both public consumption and investment. The strength in private demand came from a solid (but unspectacular) rise in household consumption (+0.7 percent q/q) and a modest rise in business investment. Housing eked out a small gain, as flagged by the Construction Work Done Survey; and net exports added 0.3ppts to growth despite the hit to coal exports from Cyclone Debbie.

On the income side of the accounts, the numbers were relatively soft, with the wages bill growing only 0.7 percent q/q, compared with the 1.2 percent reported in the Business Indicators release on Monday; while profits fell a sharp 4.3 percent. Nominal GDP fell 0.1 percent, dragged down by the 6.0 percent drop in the terms of trade.

This week’s RBA statement and Governor Lowe’s speech last night suggest that the RBA is becoming increasingly confident with the trajectory of the economy in terms of activity and the labour market although it rightly sees the consumer as a risk and would be disappointed with the ongoing weakness in wage growth.

"For policymakers, these numbers should provide some encouragement on the growth front but little on the inflation front. For this reason, we remain comfortable with our view that the Bank will keep the cash rate on hold at least until end-2018," ANZ Research commented in its latest report.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains