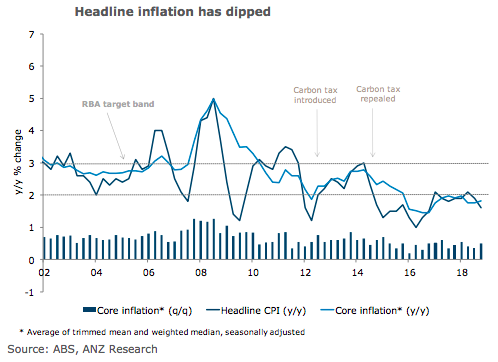

Australia’s consumer price inflation for the last quarter of 2018 is expected to see a 0.4 percent q/q rise in headline inflation in Q4, pushing the annual rate down to 1.6 percent, according to the latest report from ANZ Research.

A sharp fall in petrol prices is the largest negative for the headline figure, while retail price deflation continues to be a drag. Domestic air travel and tobacco prices will make positive contributions.

Core prices are expected to rise 0.5 percent q/q, which would leave the annual rate unchanged at 1.8 percent.

"We see the risk to core inflation for the quarter as very much to the downside. The forecast for core inflation is consistent with what the RBA published in its November Statement on Monetary Policy," the report added.

However, the evolution of headline inflation has been slower than expected, February’s SoMP can be expected to include a downward revision to the RBA’s near-term headline CPI forecast.

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains