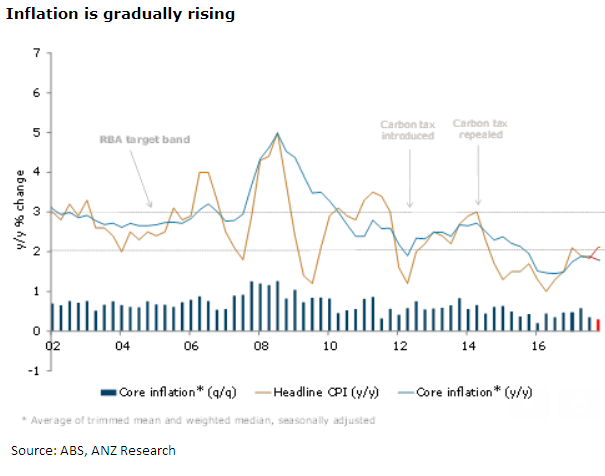

Australia’s consumer price inflation for the fourth quarter of last year is expected to show a slight pick-up in headline inflation and a broad stabilisation of core inflationary pressures. Numbers in line with forecast should support the case for a tightening by the RBA in May, ANZ Research reported.

Headline inflation is expected to rise 0.7 percent q/q for, lifting the annual rate to 2 percent y/y, from 1.8 percent in Q3 and the 1 percent low in Q2 2016. Petrol, tobacco and domestic travel and accommodation added to headline inflation in Q4. There is a higher-than-normal degree of uncertainty around this forecast given the introduction of the updated weights and methodological changes, both of which weigh on inflation.

"We expect core inflation to rise by 0.4 percent q/q and 1.8 percent y/y. This is broadly stable from the previous quarter but a clear acceleration from the 1.5 percent y/y annual rate in 2016," the report said.

Meanwhile, benign inflationary pressures continue to reflect weak wages and the impact of retail competition. With retail competition set to remain intense, the recent stabilisation in wage growth is encouraging although we continue to look for only a very gradual pick-up in wages. There does, however, appear to be some upside risk to housing inflation, given the recent strength in building approvals adding to an already solid pipeline of residential construction activity.

Lastly, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions