Australia’s construction activity weakened during the third quarter of this year and is expected to be a drag on the country’s gross domestic product (GDP), according to the latest report from ANZ Research.

Construction in Australia fell 2.8 percent in Q3, more than offsetting the solid rise in Q2. The decline was across the board, with each of the housing, non-residential building and engineering construction sectors posting falls.

Housing investment was down as expected, shedding 1 percent from its previous record level. It is believed that the decline in building approvals through 2018 will leave a significant gap in activity once the current round of projects are complete, the report added.

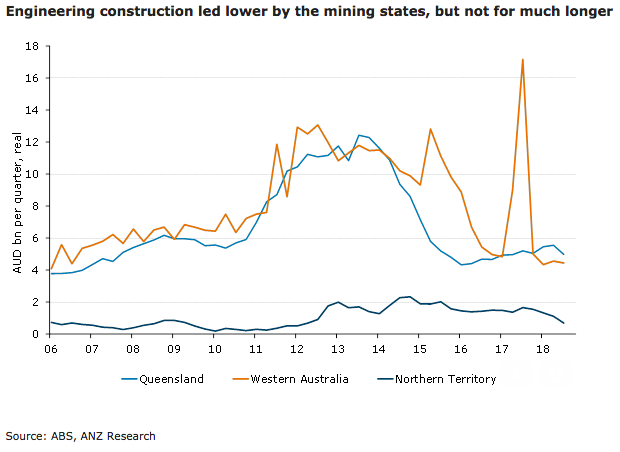

The largest driver of the decline in overall construction was privately funded engineering construction (-7.5 percent q/q). The biggest fall in total engineering was in the Northern Territory (-40 percent); this is expected to largely reflect the ongoing drop-off in mining investment as the Ichthys project nears completion.

On the other hand, publicly funded engineering construction was the best performer in Q3. While activity was technically down a fraction (-0.1 percent), it remains around a record level. Total engineering construction continued to rise in New South Wales and Victoria, consistent with the large pipeline of road and rail works currently under construction.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength