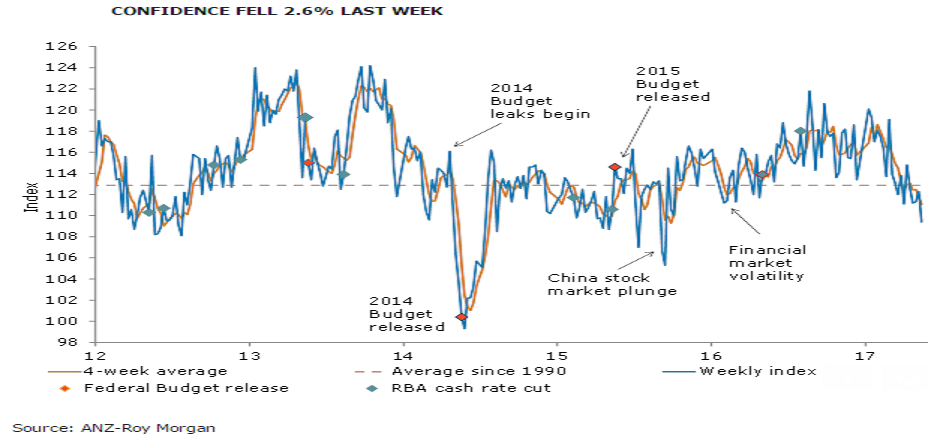

Australia’s weekly consumer confidence index started to decline again, following a downbeat view from households on their long-term economic expectations. The latest headline consumer confidence index dropped sharply, falling 2.6 percent last week. The index now sits at 109.4, the lowest level since September 2015. The four-week moving average continued to trend lower and is now 1.6 percent below its long-run average.

Four of the five indices registered sharp declines. Households’ expectations towards their long-term economic conditions posted the sharpest fall, down 5.5 percent over the week. This offset the previous two consecutive weekly gains. Views about current economic conditions fell by 3.9 percent, but remain slightly above April’s low.

Further, households’ views towards consumer’s finances turned pessimistic, with the current conditions index dropping by 3.2 percent and the future conditions index down by 4.0 percent from the previous week. Both indices were below their long-term trend last week. The four-week moving average for confidence about current finances does, however, remain above the long-run average.

In addition, the 'good time to buy a household item' was the only sub-index to rise, up 2.5 percent and reversing losses from the previous four weeks.

"Consumers may be more sensitive about their finances in an environment where house price growth is expected to moderate and low wage growth is viewed as increasingly endemic. We expect wage data tomorrow to show private sector wage growth of just 1.7 percent in the year to the March quarter, a record low," said Jo Masters, Senior Economist, ANZ.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran