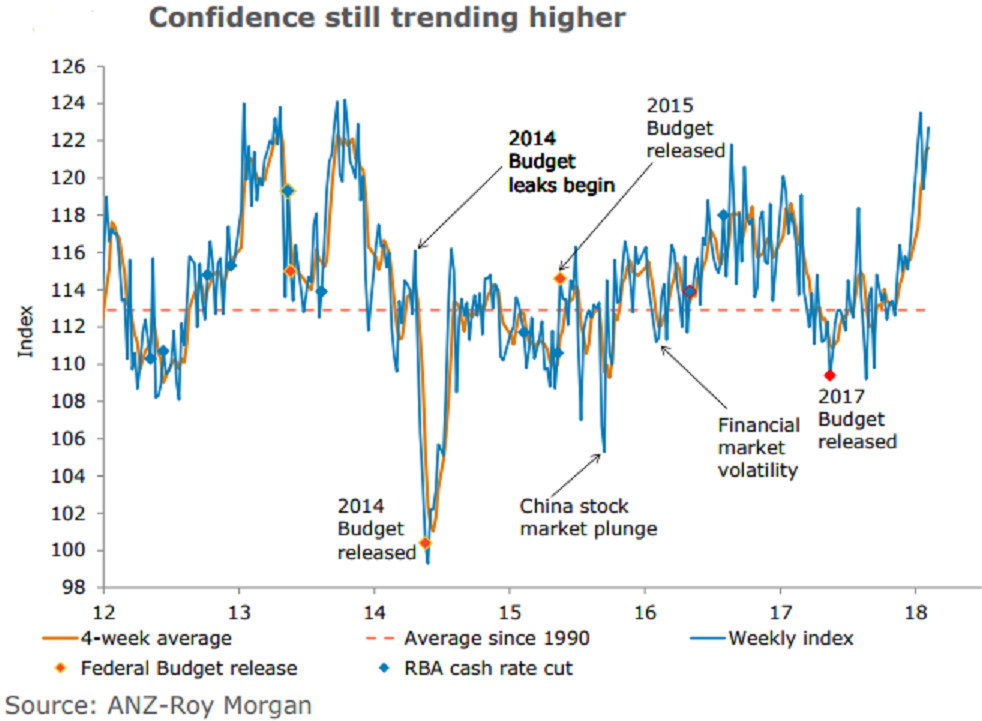

Australia’s ANZ-Roy Morgan consumer confidence rose 1.5 percent last week bringing the headline index to 122.7. The improvement in confidence was driven by increased optimism around current financial and economic conditions.

Households’ sentiment towards current economic conditions rose 4.2 percent to 120.4, the highest weekly value since November 2010. Confidence in future economic conditions slipped 0.4 percent last week, after a solid 4.2 percent rise previously. In four week moving average terms, this series has risen past its long-term average for the first time since December 2013.

Views towards current financial conditions bounced a solid 5.5 percent, partially recovering from the 10.6 percent cumulative fall over the previous two weeks. Meanwhile, future finances edged up 0.6 percent last week after a similar rise previously.

Sentiment around the 'time to buy a household item' saw its third consecutive weekly fall, slipping 1.3 percent to 139.5. The weekly inflation expectations value slipped to 4.2 percent.

"The uptrend in consumer confidence, while broad-based, has primarily been driven by a sustained improvement in views towards the economic outlook. This likely reflects strength in the domestic labor market as well as a global synchronized pickup in activity," said David Plank, Head of Australian Economics, ANZ Research.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure