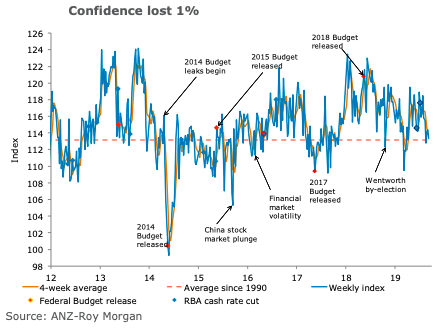

Australia’s ANZ-Roy Morgan Australian Consumer Confidence fell 1.0% last week. The fall was accentuated by a sharp decline of 7.1 percent seen in the ‘Time to buy a major household item’ sub-index.

Current finances fell by 1.2 percent, the second decline in a row, while future finances gained 1.7 percent. Both the indices are well above their long term averages.

Current economic conditions gained 1.4 percent after five straight declines. Future economic conditions gained 1.8 percent for its third consecutive increase.

Australians are still wary of the economic outlook considering both the sub-indices are below their long terms averages. Inflation expectations were stable at 4 percent on the four-week moving average.

"A steep fall in the ‘Time to buy a major household item’ led to a decline in the overall confidence index to just above its long-run average. This sub-index fell to its lowest level since April and is well below average. It seems that tax cuts, lower interest rates and the associated turn in the housing market are not yet motivating people to consider a major household purchase. Interestingly, sentiment toward the economic outlook improved despite the weak Q2 GDP report. In saying this, we need to be mindful that sentiment toward the current economic outlook had declined for five consecutive weeks to its lowest level in more than two years. So the bounce in this sub-index is only modest," said David Plank, ANZ’s Head of Australian Economics.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains