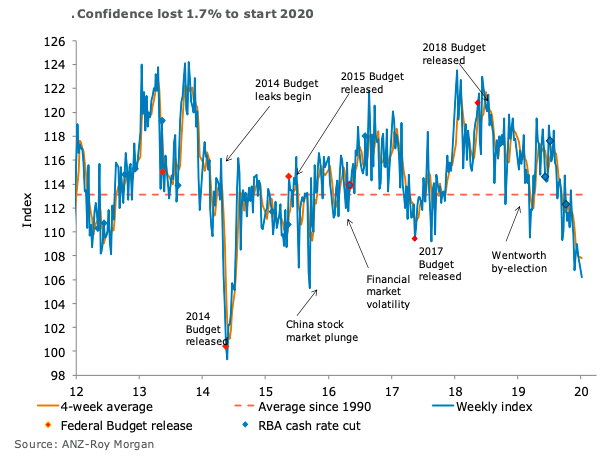

Australia’s ANZ-Roy Morgan consumer confidence fell 1.7 percent last week, to its lowest level in more than four years. A drop in confidence at the start of the year is unusual and almost certainly reflects the impact of the catastrophic bush fires over the weekend.

Consistent with this, the weakness in confidence was due to a big drop in the economic outlook, while sentiment toward personal financial circumstances actually rose.

‘Current economic conditions’ were down by a massive 12.9 percent, while ‘future economic conditions’ fell 8.1 percent. Current economic conditions are at their lowest level since the global financial crisis, while sentiment toward the future economic outlook is at its lowest level since 1994.

In contrast, financial conditions gained. ‘Current finances’ rose 4 percent while ‘future finances’ were up 0.3 percent. The ‘Time to buy a household item’ gained 4.8 percent, recovering from a fall of 6.4 percent seen in the last reading of the previous year.

Meanwhile, the four-week moving average of ‘inflation expectations’ was stable at 4.0 percent, though weekly readings saw a sharp fall, which should result in a weaker reading in the coming week.

"Against the backdrop of the weekend’s catastrophic bush fires it is not surprising that consumer confidence declined. But the reported decline of 1.7 percent since the last survey in mid-December understates the weakness when one considers that the New Year usually sees a strong gain in sentiment. The weakness in overall consumer sentiment suggests that consumer caution toward spending in recent months will continue, despite the relative health of their personal financial circumstances. We expect retail sales to have rebounded modestly in November, in part due to the Black Friday sales. But the boost may be short-lived," said David Plank, ANZ’s Head of Australian Economics.

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out