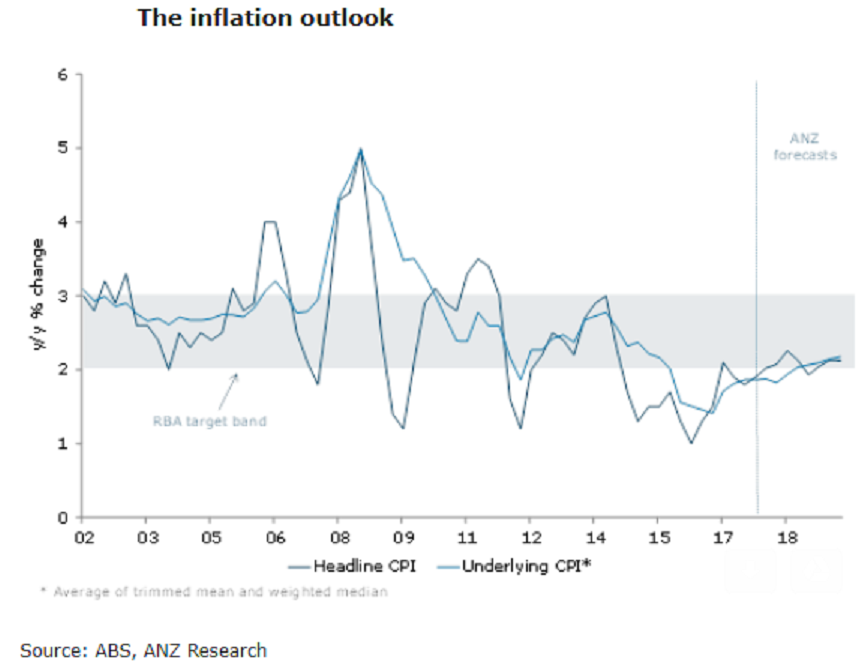

Australia’s consumer price inflation is expected to rise by 0.5 percent q/q for the first quarter of this year, with core inflation also rising by the same figure, according to a recent report from ANZ Research.

The country’s Q4 inflation print was a touch below expectations for the headline, at 0.6 percent q/q, but in line with market expectations for core, with a 0.4 percent q/q rise for both the weighted median and trimmed mean.

Overall, it was a solid result, particularly given the drag from the re-weighting. There were few surprises in the data, with headline boosted by fuel, tobacco, domestic travel, and fruit. The retail competition was still evident with a range of retail prices falling in the quarter. Overall the data suggest that inflationary pressures have stabilized just below the policy band and should rise gradually over time.

"We see this data as consistent with our view that the RBA will look to raise rates this year, with a focus on bringing the real cash rate back to zero. We continue to look for the first of two rate hikes in May, although this is based on our forecast that the WPI prints a 0.5 percent q/q rise for Q4 on 22 February," the report added.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady