Australia’s Q4 business indicators data were weaker than anticipated, with profits, inventories and wages all below forecasts. Together, these numbers provide a downside risk to forecast for a 0.2 percent q/q rise in Q4 GDP, due on Wednesday, and raise the prospect that GDP could print negative in the quarter, according to the latest report from ANZ Research.

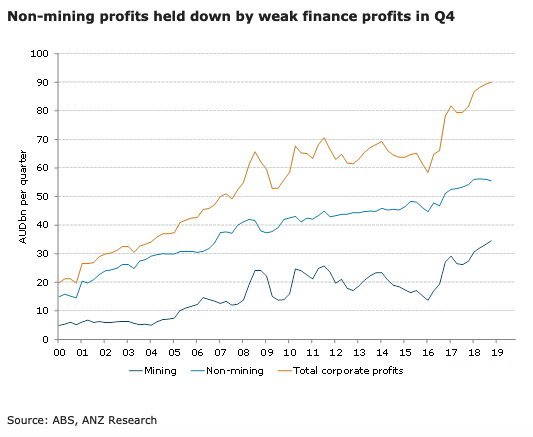

The country’s company profits posted a modest headline rise (+0.8 percent q/q) in Q4, following a downwardly revised rise of 1.2 percent in Q3 (initially reported as +1.9 percent). After adjusting for inventory valuations the result was a little better, with non-financial profits on a GDP basis rising 1.8 percent q/q.

Non-mining profits actually fell in Q4 (-1.0 percent q/q), although this number was weighed down by a reported 27 percent drop in finance sector profits. Excluding finance & mining, profits were broadly flat.

Apart from finance, weakness in profits was most evident in admin & support services, information media and arts & recreation, while profits were up solidly in hospitality, transport and professional services.

Small business profits rose a moderate 1.4 percent. Overall, the profit results are a disappointment, and difficult to reconcile with the upbeat investment plans released in the Q4 capex survey.

Growth in the wages bill was lower than we expected at 0.8 percent q/q, but the Q3 result was revised up. With the rise driven largely by gains in employment, the GDP measure of average wages is once again set to be weak.

Meanwhile, inventories were surprisingly weak (-0.2 percent q/q), which suggests that private non-farm stocks will make no contribution to GDP growth in Q4, weaker than ANZ’s expectations.

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran