Notwithstanding the outsized 42k jump in employment in May (equivalent to an annualised rate of 4.4%), net job creation is expected to have remained positive in June, albeit only just.

The recent data suggest that the job losses in mining and those sectors associated with mining investment are more than being offset by gains in residential construction, catering services and other parts of the services sector - there is little reason to expect a change in this dynamic in the near future.

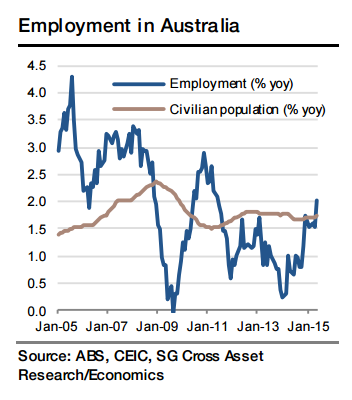

With the forecast of 5k new jobs - and ignoring likely revisions - employment growth would have slowed to an 11k average monthly gain over the three months to June, down quite sizably from the average 28k in the three months to March. However, the growth of employment in Q2 of 61k qoq (2.1% annualised rate) would not be far behind the 78k qoq (2.7% saar) of Q1. And in year-on-year terms, growth would have run at 1.8%, just ahead of the 1.7% rate of growth in the population of 15 years and up.

"With labour force growth in line with the demographic trend - i.e. an unchanged participation rate - we expect a 10k rise in unemployment, but this would not be sufficient to raise the rounded unemployment rate from 6.0%",says Societe Generale.

Australian labour market holding up well in the great transition

Monday, July 6, 2015 12:54 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed