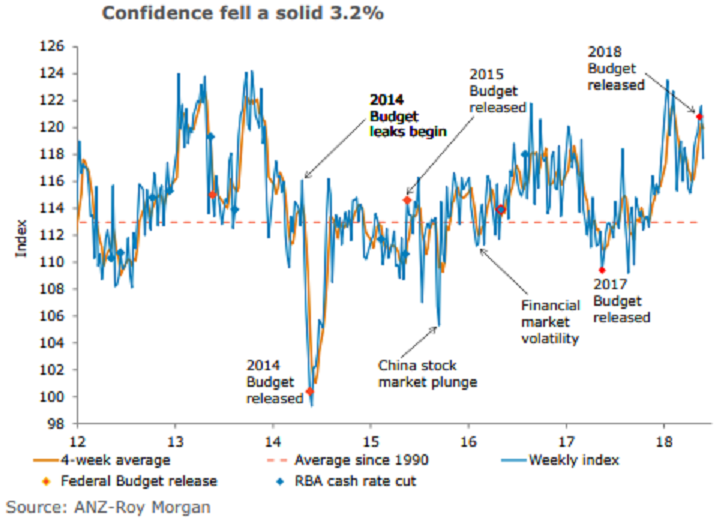

Australia’s ANZ-Roy Morgan consumer confidence dropped 3.2 percent last week to 117.7, after six straight weekly gains. The details were also negative with confidence falling across all sub-indices, led by a sharp fall in views towards future financial conditions.

Households’ views towards current financial conditions fell 2.7 percent last week entirely reversing gains over the previous two weeks. Views towards future financial conditions fell 4.1 percent to 122.5, the lowest since November last year.

Sentiment around current economic conditions eased 2.4 percent last week following no change previously. Views towards future economic conditions fell 2.5 percent last week, adding to the 1.9 percent loss in the previous week.

The 'time to buy a household item' sub-index dropped 3.9 percent last week, more than reversing the previous week’s rise (2.6 percent). The weekly inflation expectations climbed sharply to 4.7 percent.

"The fall in views towards financial conditions is a little worrying, however. This could reflect homeowners’ concerns about falling house prices, particularly in Sydney and Melbourne. Moreover, these concerns are likely exacerbated by the high existing household debt level and expectations of lacklustre wage growth in the near future. That said, despite the recent decline, views towards both current and future financial conditions remain above their long-term averages," said David Plank, head of Australian Economics, ANZ Research.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains