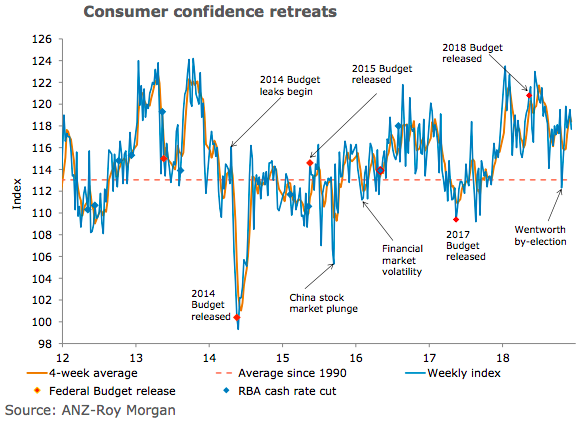

Australia’s ANZ-Roy Morgan consumer confidence fell 1.5 percent, reversing the gains seen over the previous two weeks. Consumer sentiment remains well above its long-run average, however.

Financial conditions sub-indices were mixed, with current financial conditions down 0.7 percent, while future financial conditions were up 1.7 percent. Economic conditions readings were also mixed, with current economic conditions falling by a sharp 6 percent while future economic conditions were up a modest 0.3 percent.

The 'time to buy a household item' sub-index was down 2.8 percent, its second straight loss after it made a solid gain in the second half of November. Four-week moving average inflation expectations were stable at 4.2 percent.

"A more cautious RBA statement on Tuesday and then the soft Q3 GDP figures Wednesday may have impacted consumer views on current economic conditions, which fell a sharp 6 percent. Global equity volatility may also have impacted sentiment. On the other hand, current financial conditions were only down a touch after a very strong gain the previous week and future financial conditions were up. This suggests consumers are still feeling good about their own circumstances, which is somewhat at odds with the weak wage data in the Q3 GDP report," said David Plank, Head of Australian Economics, ANZ Research.

Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality