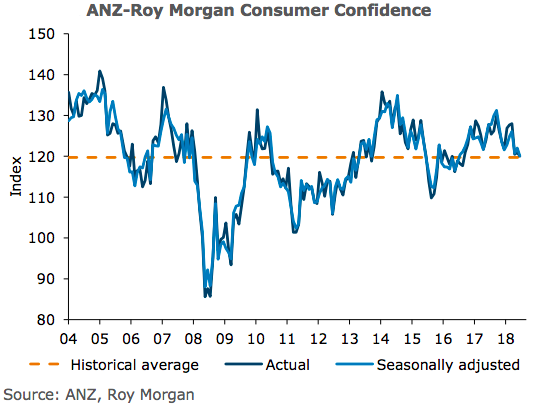

Australia’s ANZ-Roy Morgan consumer confidence Index, slipped 1 point to 120 in June, its lowest level since August 2016. On a seasonally adjusted basis the index fell 2 points, also at 120. Current conditions remain upbeat, but households are wary about the outlook.

Strong labour market conditions and still-low interest rates are supporting household sentiment, but slowing economic growth may be dampening perceived prospects, particularly given the backdrop of high household debt and elevated housing costs.

The Current Conditions Index rose 1 point to 125.7 in June, exactly in line with its 12-month average and well above its historical average of 116.7. The Future Conditions Index fell 2 points to 116.2; well below its average (121.7).

Perceptions regarding the next year’s economic outlook eased a further 5 points to 7 percent, the lowest reading since August 2016. The five-year outlook also dipped, down 1 point to 16 percent. Confidence fell a further 2 points in Auckland, which remains the least confident region. The rest of the North Island is also relatively subdued. Regional South Island and Wellington confidence both slipped 3 points.

Expectations for national house price inflation dipped from 3.7 percent y/y to 3.6 percent, with Wellingtonian expectations no longer leading the pack, down 1 percentage point to 3.2 percent. General inflation expectations were unchanged at 3.9 percent.

"In our view, consumer confidence around average isn’t necessarily a bad thing; particularly given we’re late in the cycle. A strong rise in household debt wouldn’t be optimal from a financial stability standpoint, and a modestly higher saving rate wouldn’t go amiss in terms of building household’s resilience for the inevitable rainy day," ANZ Research commented in its latest report.

Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks