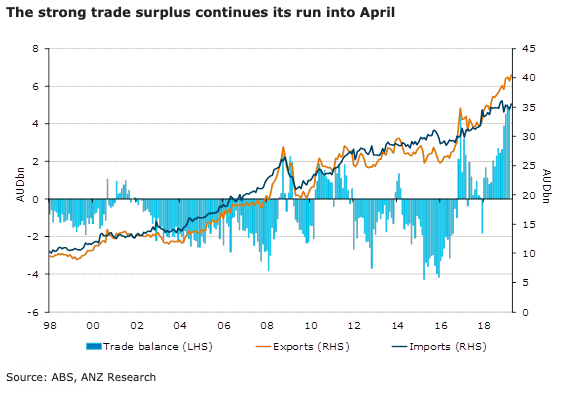

Australia’s strong run of trade balance surpluses continued into April, with the trade balance essentially unchanged from March. Underlying this were increases in both exports and imports. Exports rose on strong growth in iron ore and non-monetary gold. An increase in imports followed increased capital goods imports and higher fuel imports, likely reflecting price effects.

The monthly trade balance was broadly unchanged from March, coming in at a AUD4,871 million surplus in April, the third highest on record. Underlying this were a 2.5 percent rise in exports and a 2.8 percent rise in imports in April.

Resource exports rebounded 3.7 percent mostly offsetting March’s fall. This was led by metal ores and minerals being up 16.2% in the month and non-monetary gold up 19.5 percent.

"We think the increase in metal ore exports was largely due to an increase in iron ore prices and volumes rebounding from the impact of cyclones in Western Australia," ANZ Research commented in its latest report.

Rural goods were down 1.6 percent, led by declines in cereals and other goods. Manufacturing exports were up 1.2 percent and service exports up slightly at 0.8 percent as travel increased 1.3 percent.

Imports intermediate and other merchandise goods increased 4.0 percent m/m, largely due to a 9.2 percent increase in parts for capital goods and a 3.7 percent increase in fuel imports. Much of this was likely due to higher prices.

Imports of capital goods increased 4.4 percent m/m, led by transport equipment increasing 18.5 percent, rebounding after the sharp fall in March. Consumption goods imports increased 3.5 percent m/m, on a 5.9 percent increase in car imports. Service imports were broadly flat, decreasing 0.1 percent m/m, reflecting a 0.9 percent increase in travel and 0.5 percent fall in transport.

"We see further strong trade balances helped by elevated commodity prices, a pick-up in iron ore volumes and a depreciating Australian Dollar," the report added.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data