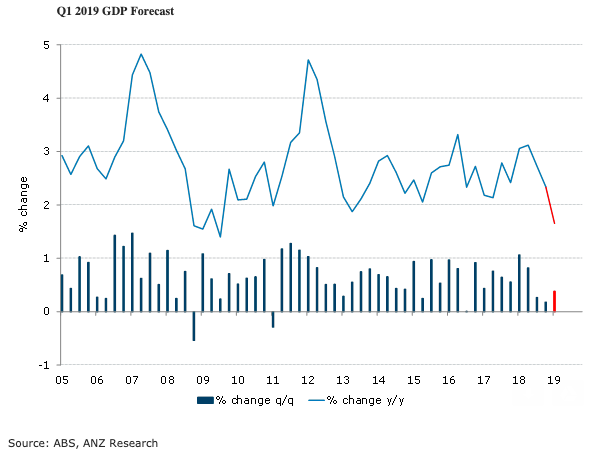

Australia’s gross domestic product (GDP) for the first quarter of this year is expected to post another disappointing rise in GDP of 0.4 percent q/q, according to the latest report from ANZ Research. This would see annual growth decline to 1.7 percent - its slowest pace since 2009 in the midst of the global financial crisis.

GDP growth, at +0.4 percent q/q and +1.7 percent y/y, looks to be a little lower than the RBA expected at the time of its May Statement on Monetary Policy, with the Bank’s June forecast of +1.7 percent y/y requiring growth of 0.6-0.7 percent q/q on average in Q1 and Q2.

For the RBA, the surprise weakness looks to have come from business investment which partial data suggest was soft again in Q1.

In Wednesday’s report, the focus will once again be on the household indicators – consumption and income. Weak retail sales volumes (-0.1 percent) point to relatively modest growth in consumer spending. While retail spending accounts for only around 30 percent of consumption, falling house prices and ongoing soft income growth will have weighed on consumer spending in the quarter.

"We will also be watching the GDP measure of average wages. Preliminary data suggest this is likely to continue to show only fairly modest growth," the report further commented.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data