Data released earlier today by the Australian Bureau of Statistics showed Australia's Q2 CPI data were broadly in line with market expectations. Consumer prices in Australia rose 1.0 percent on year in the second quarter of 2016, shy of forecasts for 1.1 percent and down from 1.3 percent in the three months prior. It was the lowest annual rate since 1999 and highlighted the impact of low wage growth and competitive pressures.

On a quarterly basis, CPI was up 0.4 percent, in line with forecasts and compared to the 0.2 percent contraction in Q1. The average of the core measures rose by 0.5 percent q/q and 1.5percent y/y. CPI ex-volatiles, another measure of underlying inflation pressures rose by 0.3 percent q/q and 1.6 percent y/y. Disinflationary forces were evident across both tradables and non-tradables prices. Non-tradables inflation recorded its fourth consecutive 0.4 percent q/q rise, but continues to decelerate in year-on-year terms.

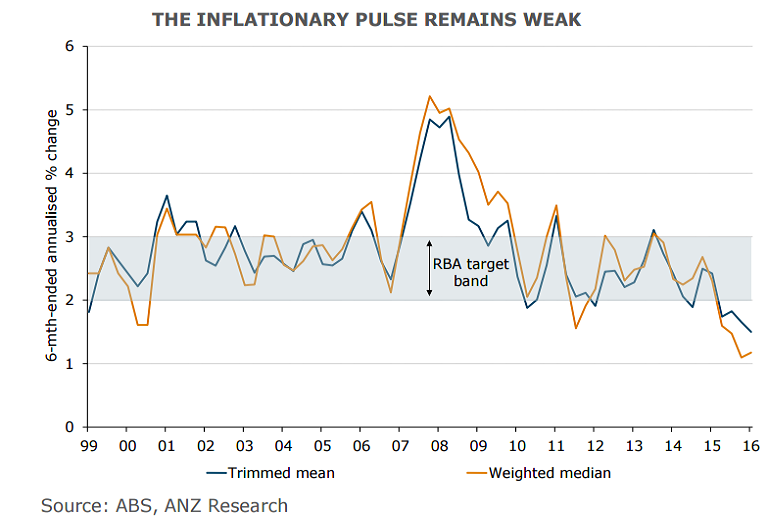

In the Reserve Bank of Australia’s July statement following its rate decision, Governor Glenn Stevens noted that persistently low inflation is likely here to stay. The RBA cited labor market costs and downward pressures from elsewhere in the world for the lack of growth. The RBA lowered interest rates in May 2016 and twice in 2015 to spur inflation and lending.

Following the release of the report, financial markets have priced out the likelihood that the Reserve Bank of Australia will cut interest rates when it meets on August 2. Cash rate futures currently put the odds of a 25 basis point rate cut at around 50%, down from 67% prior to the release, while Australian 3 and 10-year bond futures have weakened by 4 and 3.5 ticks respectively.

"Underlying inflation is expected to remain at, or below, the RBA’s forecast band over the next 12-18 months. This weak inflation profile, combined with softer labour and housing markets and a relatively elevated AUD, is likely to see the RBA cut the cash rate by 25bps, to 1.5%, at its policy meeting next week," said ANZ in a report to clients.

The move in the Australian dollar has been muted. It briefly rose as high as 0.7566 in the immediate aftermath of the release. The pair has since erased gains to slip back below the 0.75 handle and was trading at 0.7483 levels at 10:00 GMT.