Australia’s business profits and stocks for the second quarter of this year is expected to weigh on the country’s gross domestic product for the similar period, given that the Q2 business indicators release was soft, with weakness in profits and inventories outweighing strength in the wage bill. However, the ongoing uptrend in non-mining profits augers well for the business investment outlook, while the improvement in the wage bill will support household incomes.

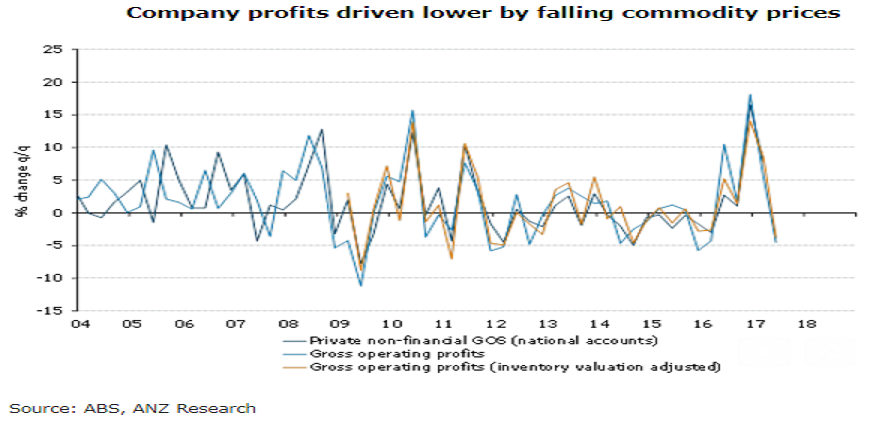

Following strong rises in the previous two-quarters, company profits fell 4.5 percent in Q2. The volatility continues to be largely driven by commodity prices, with mining profits down 11.5 percent q/q after an 11 percent rise in Q1. Non-mining profits were also a touch weaker (-0.6 percent q/q) although this follows two-quarters of strong gains, and on an annual basis, they are up 10.9 percent.

Growth in the wages bill picked up in Q2 supported by strong growth in employment (particularly in full-time jobs) in the quarter. Wages rose a solid 1.2 percent q/q, following a 0.2 percent rise in Q1 (downwardly revised from +0.3 percent), bringing annual growth up to 1.6 percent. This strength will provide some offset to weak profit growth in GDP.

Inventories fell 0.4 percent q/q in Q2, following the sharp 1.1 percent gain in Q1. This was considerably weaker than market forecasts (+0.3 percent q/q) and suggests that stocks will take a hefty 0.6ppt off GDP growth in Q2.

"We expect the weakness in non-mining profits to be temporary, given strong business conditions and reported profitability in the business surveys," ANZ Research commented in its latest report.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January