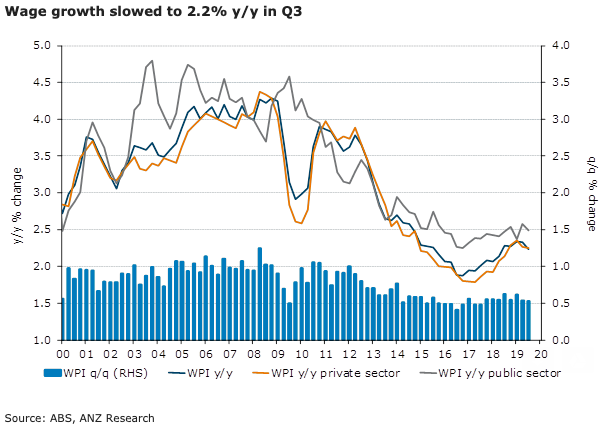

Australia’s wage price index (WPI) rose by 0.5% q/q in Q3 2019, slowing annual growth to 2.2%. With the Q2 result inflated by a significant, one-off increase in Victorian public sector health wages, the Q3 result is seen to be more reflective of the rise in labour market underutilisation since early 2019, along with the deterioration in enterprise bargaining agreement (EBA) wage increases since late 2018.

The slowdown in wage growth is not unexpected, but it will put further pressure on household incomes.

The private sector maintained quarterly growth at 0.5 percent, but this wasn’t enough to prevent annual growth slipping to 2.2 percent, down from 2.4 percent in Q1. However, including bonuses, private sector wage growth jumped to 2.9 percent y/y. This effectively reversed the prior quarter’s fall, and we don’t think it points to an upward shift in wage outcomes.

Public sector wage growth dropped back to 0.5 percent q/q. This followed a very strong 0.8 percent q/q result in Q2, which was inflated by a significant, one-off increase for Victorian public sector nurses and midwives to achieve parity with New South Wales. Annual growth in public wages slowed to 2.5 percent.

Most industries saw annual wage growth slow in Q3, with the largest decline in other services (-0.4ppt). Transport (+0.2ppt) and professional services (+0.1ppt) were among the few that saw improvement. Annual wage growth in construction and retail was unchanged during the quarter.

Victoria maintains the strongest wage growth in the country at 2.8 percent y/y, followed by the ACT (2.5 percent y/y). While some economic indicators have been showing recent positive signs for Western Australia, this doesn’t appear to be flowing through to wages yet, with growth still at 1.6 percent y/y.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions