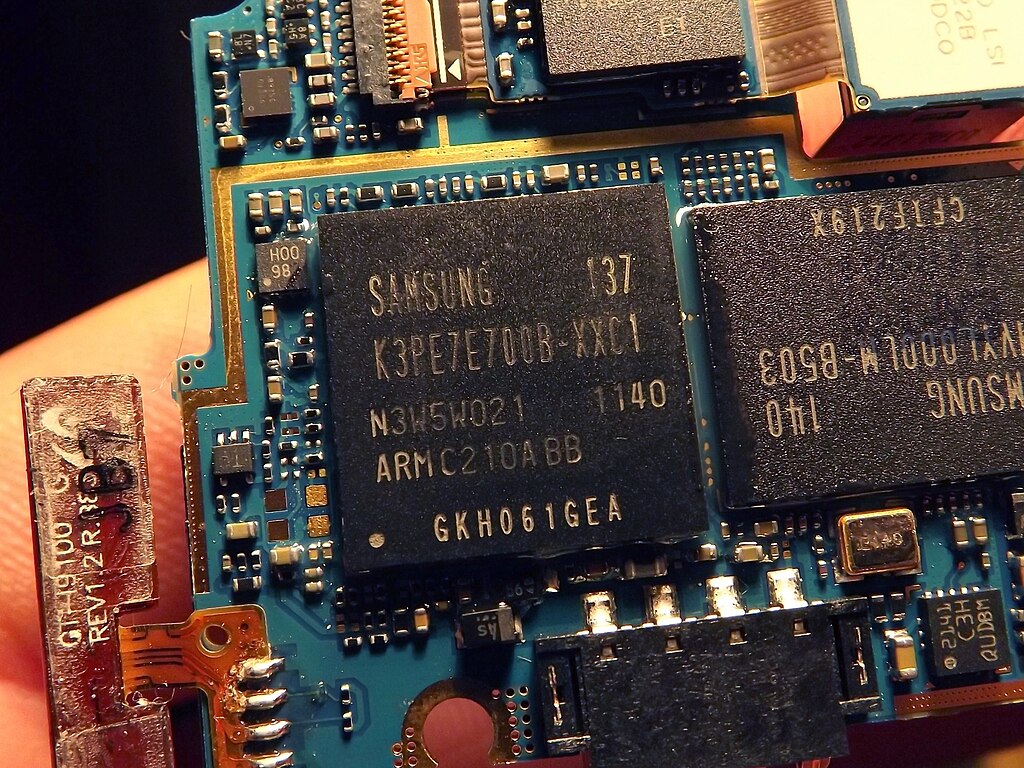

Samsung Electronics reported a better-than-expected 0.2% drop in Q1 operating profit, reaching 6.6 trillion won ($4.49 billion), beating market forecasts of 5.1 trillion won. This resilience was driven by solid memory chip sales and robust demand for its Galaxy S25 smartphones, boosted by AI features and early orders from North American buyers anticipating potential U.S. tariffs.

Analysts noted that demand for conventional and AI memory chips exceeded expectations as customers stockpiled semiconductors ahead of possible U.S. trade actions. Despite a dip in general memory prices, shipments remained strong, supported by tariff-related concerns. Samsung shares rose 2.6% following the announcement, outperforming the KOSPI’s 1.6% gain.

Samsung’s Q1 profit is nearly flat compared to 6.61 trillion won a year earlier and slightly up from 6.49 trillion won in the previous quarter. However, analysts expect a weaker Q2, with shipment declines likely as demand normalizes. Delays in acquiring clients for high-bandwidth memory (HBM) chips could also weigh on future performance.

Samsung’s foundry division, which manufactures chips for Nvidia, Qualcomm, and AMD, likely faced losses that offset some of the gains from the memory business. The company previously cited U.S. export restrictions to China—its top market—as a factor limiting AI chip sales.

While Samsung plans to begin supplying its upgraded HBM3E 12-high chips to Nvidia mid-year, executives warned of ongoing challenges and apologized in March for lagging behind in the AI chip race. The company anticipates improved performance in the second half, driven by demand from smartphones and data centers.

Samsung will release full Q1 results on April 30. Meanwhile, rivals like SK Hynix and Micron are also experiencing strong AI chip demand, although caution remains around long-term recovery trends.

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies