In October, Australia's job report surprised everyone, with unemployment drop of 0.3% amid rising participation rate, more job permanent job addition.

However, all is not good, when one takes a look at Australia's mining and manufacturing industry. Slowdown is considerable. Iron ore which contributes almost one-fifth of Australian exports and 4-5% of GDP is trading at seven year low. Australian exports to China major of which contains coal and iron ore has dropped and dropping sharply.

There are little signs as of now that these slow down would change course any time soon.

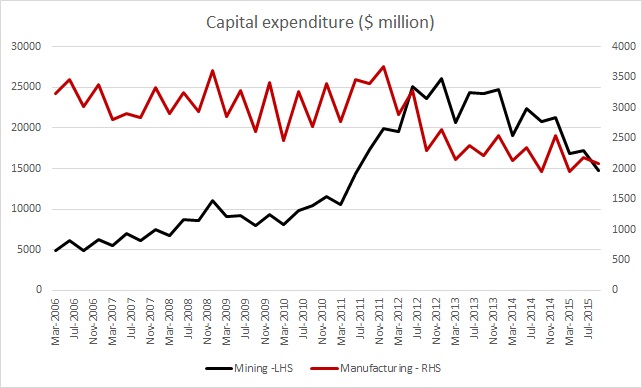

Slowdown has especially gathered pace since 2003. Companies are reducing capital expenditure sharply, which is a broader indication of future growth expectations. Slowdown in mining and lack of requirement of mining products has also led to slow down in manufacturing.

Since 2013, capital expenditure has dropped more than 40% till September quarter this year and drop is gathering pace. Overall capital expenditure is down -9.2% from last quarter and -20% from a year ago. Mining capex contributed to -14% drop, while manufacturing capex dropped -4.3% from last quarter.

In spite of strong service sector, gloom around Australian economy is here to stay.

Australian Dollar is relatively stronger, due to weaker Dollar, currently trading at 0.721

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed