Australia’s retail sales beat market expectations for the month of February, growing at the strongest pace since July 2017, with gains broadly based across sectors. New South Wales and Victoria again led the growth of these states benefiting from strong employment growth.

Retail sales rose 0.6 percent m/m in February, following an upwardly revised 0.2 percent m/m rise the previous month. Encouragingly, retail sales rose by 3 percent y/y in February, up from 2.1 percent y/y the previous month and the strongest annual rate of growth since July 2017.

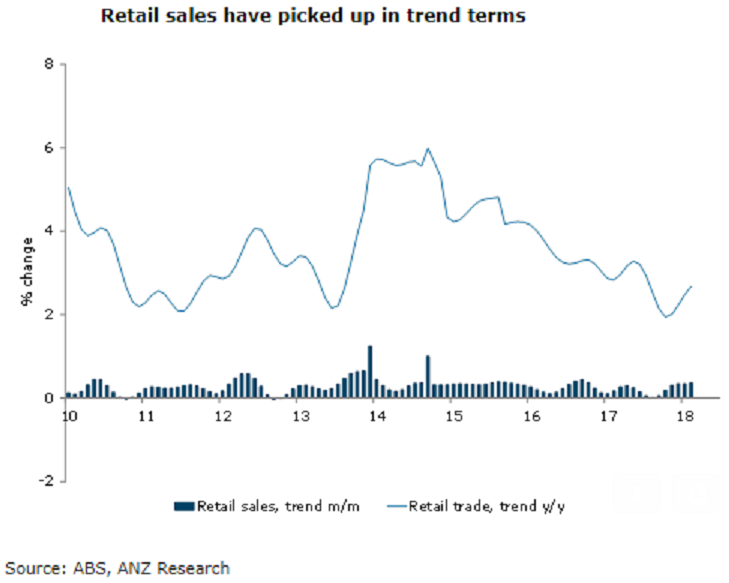

In trend terms, retail sales rose by 0.4 percent m/m, the strongest monthly rise since October 2016, with annual sales up 2.7 percent y/y in trend terms. Indeed, in trend terms, sales have clearly picked up from the weakness evident in mid-2017.

The strength in retail sales was broadly based, with all sectors showing a rise in sales. Department stores (up 1.5 percent m/m), household goods (1.1 percent m/m) and clothing & soft goods (1.1 percent) were particularly strong. Other retailing rose a soft 0.2 percent m/m, dragged lower by a sizable 5.7 percent m/m decline in newspaper and book retailing.

"While it’s encouraging that retail sales didn’t falter again, we remain cautious about the outlook given the challenges facing household balance sheets. Anaemic wage growth, record high debt, slowing house price growth and most recently a stalling in consumer confidence all act to offset the strength in jobs growth," ANZ Research commented in its latest report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility