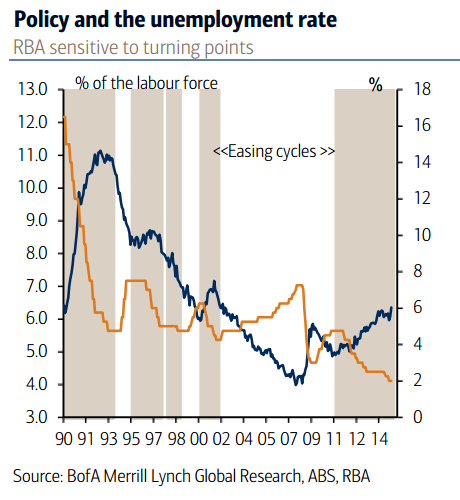

Unemployment rate is a key input in the RBA's reaction function because it is a precursor to domestically generated inflation. It has been observed that wage inflation invariably accelerates around six months after the unemployment rate has peaked. However, for now, the RBA's expects the unemployment rate will continue to rise and concludes that "historically low wage growth" will ensure "inflationary pressures were well contained and likely to remain so in the period ahead."

Core inflation is expected to remain at the bottom half of the target band and RBA continues to have policy flexibility if growth deteriorates. But if the unemployment rate were to have peaked already, then a modest re-acceleration of wage growth could occur much sooner than currently expected. And this could leave the RBA in the arguably uncomfortable situation where tradeables inflation and wage growth were accelerating.

Data today showed that Australian total hourly wage rates ex bonuses (WPI) rose 0.6% in Q2, bang on market expectations. It followed a 0.5% qtr in Q1 and three consecutive 0.6% qtr prints. The annual pace was a record low of 2.2%yr from 2.3%yr in Q1 (revised from an original estimate of 2.2%yr).

Wage inflation has decelerated to an extent not observed previously in the current data series and average earnings growth is the weakest it has been since the 1990s recession. The reasons for this likely include still high job uncertainty deterring wage negotiations; significant spare capacity and abundance of labour inputs; and a need for export competing industries to improve unit labour costs, which remain high and are still undermining competitiveness despite the AUD declining.

Australia's economic growth is mired below trend and has been for some time, yet the unemployment rate has stabilized in recent quarters in trend terms (notwithstanding this month's volatile outcome). It had even showed some very early signs of decline and raised the question - Has the unemployment rate peaked? This stabilization of the unemployment rate allows the RBA to leave rates on hold despite soft economic growth.

Nonetheless, there are good reasons to expect the unemployment rate to rise further. The increase will not be a consequence of a cyclical economic slowdown and a marked upward move, but more due to structural factors in the economy. Therefore, it is not believed this occurrence will be met with a policy response from the RBA.

The Aussie, widely considered a more liquid proxy for China plays, plunged to as low as $0.7217, its lowest since mid-2009 on the latest PBOC devaluation triggered sell-off. AUD/USD is currently trading at 0.7334, recovering largely on short-covering.

Australia's unemployment rate likely to drift higher

Wednesday, August 12, 2015 10:58 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?