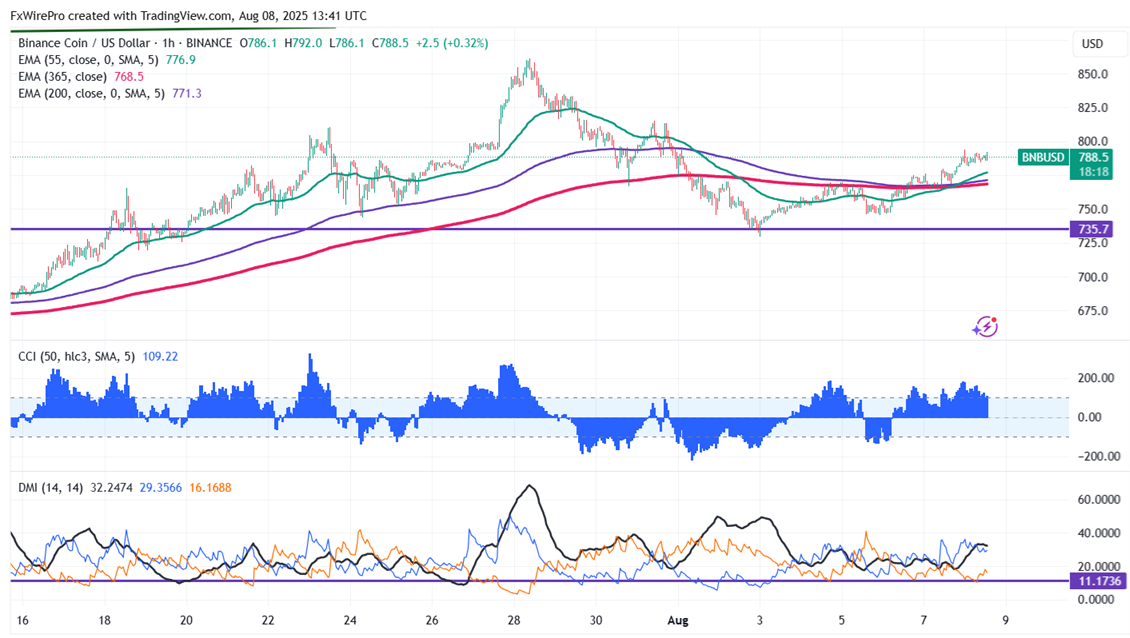

BNB/USD has been consolidating in a narrow range between 793 and 768.50 for the past two days. It hits an intraday high of $790 and is currently trading around $788.20.

Short-term trend remains bullish as long as the support $698 holds. It trades above the 55 and 34, below the 200 and 365 EMA on the 1-hour chart. Near-term support is around $729; any close below targets $700/$670/$650/$644/$628/$598. If the pair closes below $500, potentially lead to further declines towards $400.

Immediate Resistance is at $780.Any breakout above this resistance confirms bullish momentum and a jump towards $800/$820/$830/$862/$900/$1000.

Indicators ( 1-hour Chart)

Directional Movement Index: Bullish

CCI (50): Bullish

Trading Strategy

It is good to buy on dips around $700 with a stop-loss set at $600 and a target price of $1000.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary