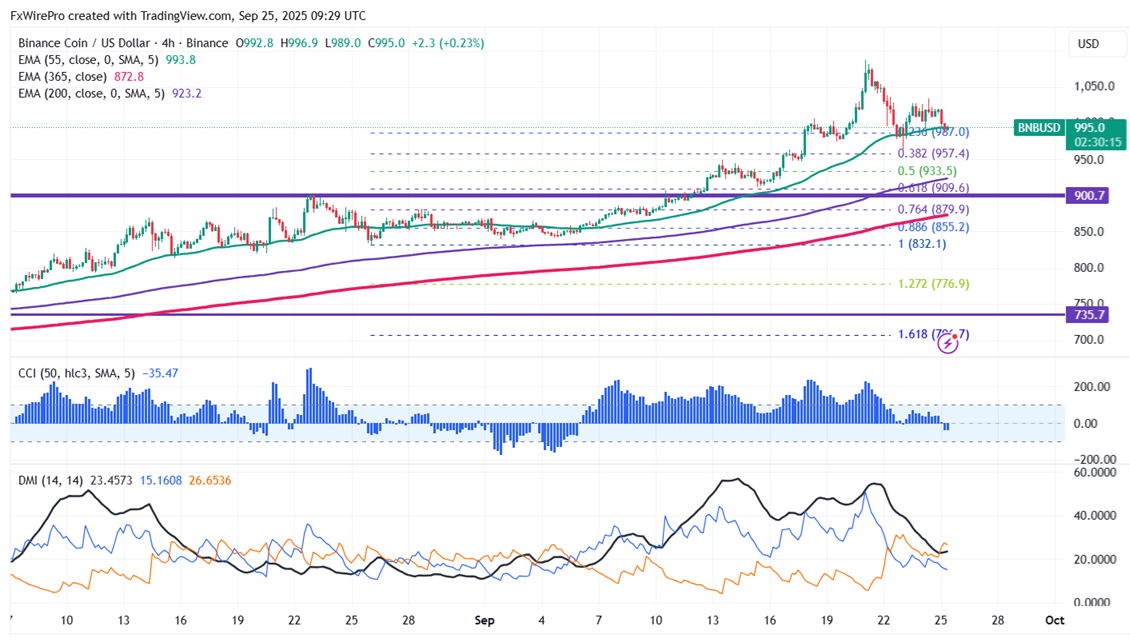

BNBUSD showed a minor sell-off due to profit booking. It hits an intraday low of $986 and is currently trading around $995.80.

Short-term trend remains bullish as long as support $872 (365 4H EMA) holds. It trades above the 55,200 and 365 EMA on the 4-hour chart. Near-term support is around $985; any close below targets $960/$940/$928/$900/$865/$845/$810/$780/$755/$740. If the pair closes below $500, it potentially leads to further declines towards $400.

Immediate Resistance is at $1035.Any breakout above this resistance confirms bullish momentum and a jump towards $1050/$1100/$1150/$1200.

Indicators ( 4-Hour Chart)

Directional Movement Index: Neutral

CCI (50): Bearish

Trading Strategy

It is good to buy on dips around $980 with a stop-loss set at $940 and a target price of $1150/$1200

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary