The governor of BoJ mentions in his speech earlier today those economic situations have improved after introducing QQE (Quantitative & Qualitative Monetary Easing). He also specifies YoY rate of increase in the consumer price index (CPI) declined due mainly to the effects of the substantial decline in crude oil prices.

Effects of QQE:

Raise in Inflations expectations

Downward pressure on nominal interest rates (through Japanese Government Bond Purchase)

The Decreasing Effects on Real Interest Rates

Technical & Derivatives Insights:

Although this pair shows downward pressure with relative strength index converges the downswings with price curve. Weekly stochastic also signals dips in medium term but the crossover %D line is not that significant as did not occur above 80 levels which could be deemed as overbought situation. Hence, it is going to be minor rise in price on sideway sentiments, the bears who dominate in medium term though.

Derivatives strategy:

Option Strategy: Combinations

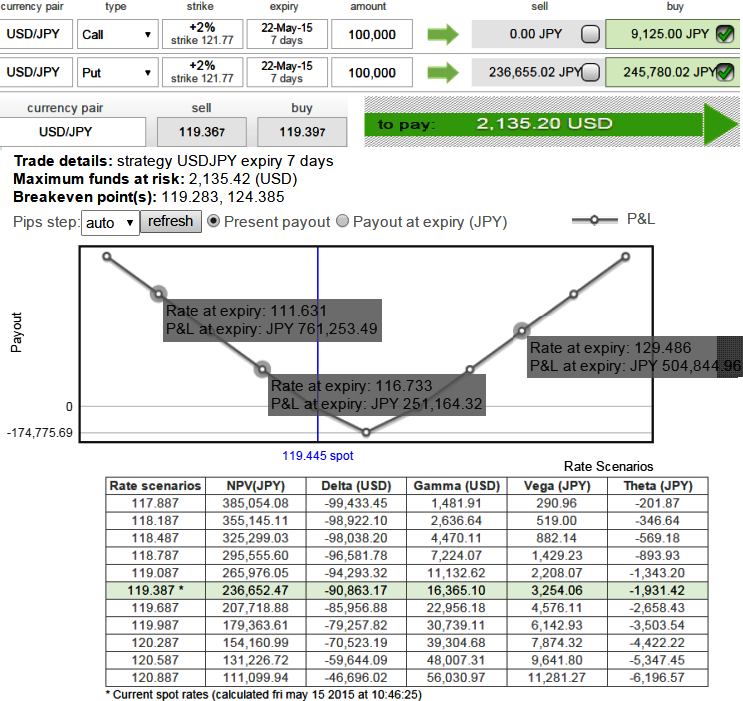

We are advising to buy call and put options of same strike prices and same expiry so as to make it a Straddle. Considering this strategy if price breakout on either side, the portfolio would show you hedging effect. It is preferred to buy ATM call and ATM put option simultaneously and both contracts are to be of far month (3 month expiry).

As shown in the diagram, this scenario makes money only if underlying currency moves up or down substantially beyond breakeven point by expiration.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings