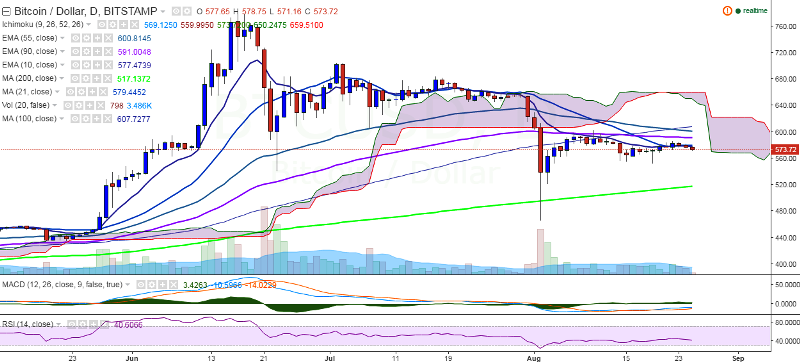

BTC/USD weakened further on Thursday and continues to trade in the red at 573.67 levels at the time of writing (Bitstamp).

Long-term trend: Bullish

Ichimoku analysis of daily chart:

Tenkan Sen: 569.12

Kijun Sen: 561.39

Trend reversal: 591.39 (90-day EMA)

“BTC/USD has declined after making a high of 585.95 levels (August 22 high) and is trading well below 21-day MA. The pair will resume uptrend only above 90-day EMA”, FxWirePro said in a statement.

Major resistance is seen at 591.39 (90-day EMA) and a break above would target 606.52 (100-day MA)/ /634 (161.8% retracement of 603 and 522.30).

On the flipside, the pair may find support at 550 (psychological level) and break below would send the pair to 514 (200-day MA)/465.28 (August 2 low).

BTC/USD plunges further, dip till 550 likely

Thursday, August 25, 2016 7:15 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary