BTC/USD has recovered sharply after making a low of $540 yesterday (Bitstamp). It is currently trading at $648.76, at the time of writing.

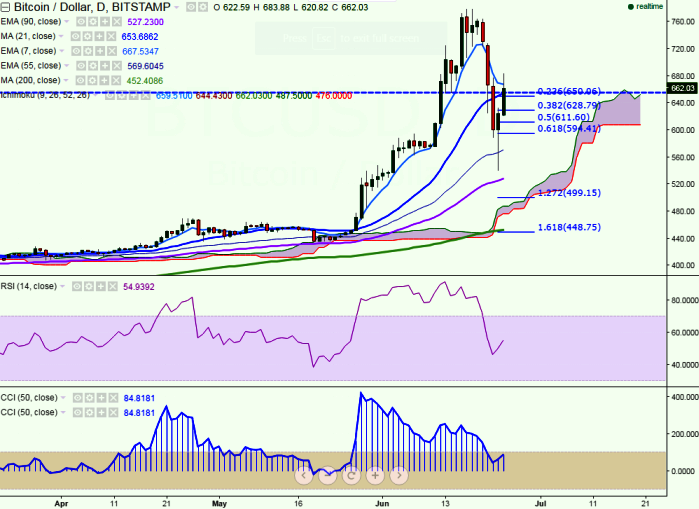

Ichimoku analysis (Daily chart):

Tenkan-Sen level: $659

Kijun-Sen level: $631.92

Trend reversal level - (90 day EMA)-$524

The long-term trend is bullish and major resistance is around $689 (61.8% retracement of $778 and $540) and any break above targets $725/$750. Short term support is likely to be found at $630 and any violation below will drag the pair till $595 (61.8% retracement of $540 and $683). Short-term trend is weak for the pair.

“BTC/USD has broken 21 day MA and jumped till $683 from that level. So a slight jump till $725/$750 is possible”, FxWirePro said in a statement.

According to CoinDesk, bitcoin’s recent rally seems to be driven by the UK’s European Union referendum. BitFury Group ViceChairman George Kikvadze said in a tweet:

Shocking: with over half of votes counted: 51.5% #Brexit ; 48,5% IN. As a result #bitcoin major rally UP

— George Kikvadze (@BitfuryGeorge) June 24, 2016

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary