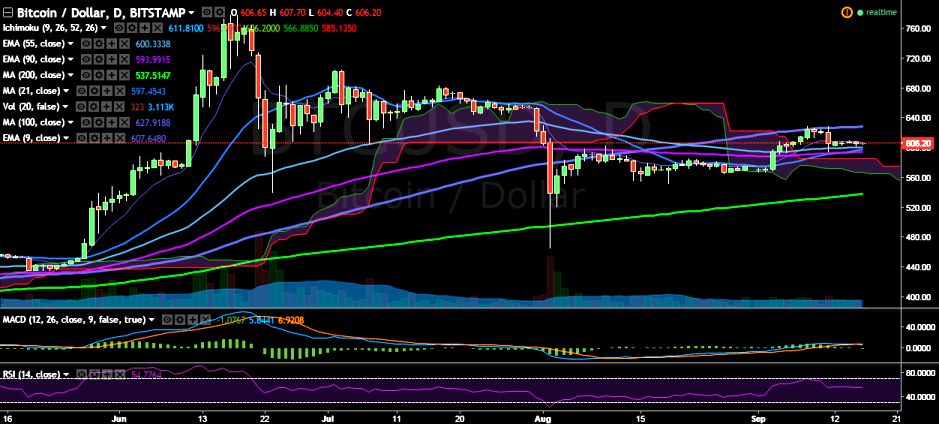

BTC/USD remained largely flat this week, trading in a narrow range between 600-610 levels. It is currently trading at 606.95 levels (Bitstamp).

Long-term trend: Bullish

Ichimoku analysis of daily chart:

Tenkan Sen: 611

Kijun Sen: 596.90

Trend reversal: 593.71 (90 EMA)

The pair’s uptrend is being capped by 9-EMA and it must break above for further jump. It faces major resistance at 627.68 (100-day) and a break above would see the pair testing 653.69 (78.6% retracement of 704.99 and 465.28)/ 705 (July 3 high).

On the flipside, the pair has been successfully holding above 600 levels. A break below would target 593.71 (90 EMA)/ 547.14 (50% retracement of 465.28 and 628.99)/ 536.65 (200-day MA).

BTC/USD trades flat, bullishness only above 630

Friday, September 16, 2016 7:16 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary