Business sentiment indicator of the France's central bank is likely to release today. The French flash services PMI figure was revised upwards from 52.3 to 52.7 last week.

The business sentiment indicator of the central bank is expected increase from 97 to 98 for October, estimates Societe Generale. The indicator is expected to be driven by the increased disposable income and higher corporate profit margins.

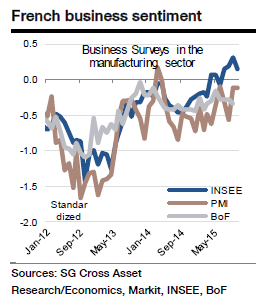

As the above chart shows, the indicator has enough scope to reach the PMIs and the reliable INSEE survey, and exceeding to 99 is likely to be possible (long-term average = 100).

Bank of France October business sentiment to perform well

Monday, November 9, 2015 4:45 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed