Today CBI industrial trend survey was published at 11 GMT. Market and the pound especially unmoved, though less volatility is not unusual given the data's low key status.

Nevertheless as always, we felt the urged to consider the impact of the data, especially when it is a leading indicator to the economy. The data point is also pivotal in assessing the situation from the business' point of view.

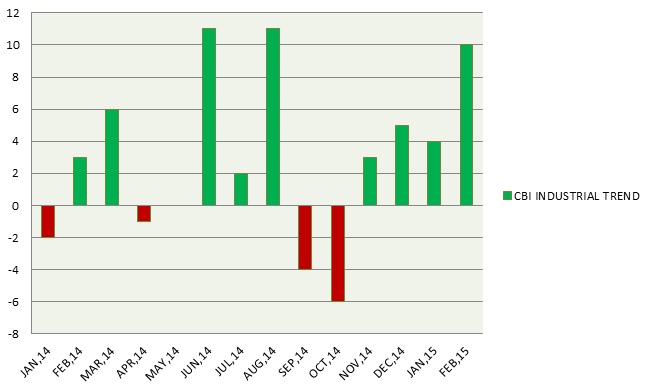

- The data was better than expected at 10 compared to previous 4. Interesting part is that the data has been firming up for quite some time now, as well as some of the other economic indicators like unemployment, construction etc.

- This does not change our view immediately over pound against dollar. Instead we view the headwinds from the inflation, rate outlook and trade balance is of much stronger.

We included the data points for past one year in our chart.

These developments keep us favorable to pound against many other majors and emerging market rivals but the dollar.

Currently EUR/GBP is trading at 0.7370 falling from 0.8 in December 2014. GBP/JPY is trading at 183.2, up 800 around pips since January, 2015.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?