We all have seen that BTCUSD’s bullish rout in the recent past. But for now, the price behaviour of Bitcoin has been volatile due to turbulence news that has been lingering around this asset class.

Technically, bulls of this pair, in the medium-term, managed to break-out stiff resistance as anticipated. However, more upswings likely as long as the strong support levels hold at 7DMA or $7,855 areas, while the current prices are still well above 21DMA with bullish crossovers & overbought sentiments.

While SEC (Security Exchange Commission) clarified that the Bitcoin exchange-traded fund (ETF) request made by the Winklevoss twins, was unlikely to get approval anytime in near future. The major argument against the Winklevoss petition centres on the fact that they are unable to inhibit price manipulation with the ETF, according to the declarations.

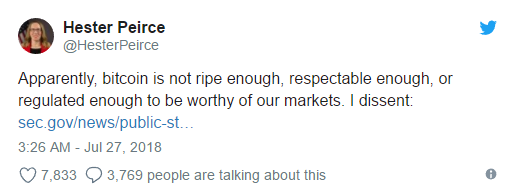

After this announcement of the SEC, Hester Peirce, the SEC commissioner, makes her opinion on the subject that she absolutely disagreed with the decision of the SEC on the case. She clarified on her twee (refer above exhibit for the tweet).

Consequently, the trend of BTC goes in sideways you easily make out from the above technical chart.

Those who are sceptic about potential slumps and want to hedge their BTC positions can test their luck into bitcoin futures contracts on CME and CBOE.

As these Bitcoin derivatives contracts offer an instant, cost-effective method of crypto trade markets. They are standardized contracts to buy or sell a particular asset at a set price, on a set date in the future, in predefined quantity and quality.

Currency Strength Index: FxWirePro's hourly BTC spot index is inching towards 71 levels (which is bullish), while hourly USD spot index has bearish index is creeping at 37 while articulating (at 05:46 GMT). For more details on the index, please refer below weblink: