Canadian and Japanese central banks have maintained status quo in their monetary policies this week. The Bank of Canada held its overnight rate at 1.25% on March 7th 2018, following a 25bps hike in the previous meeting, saying that while the economic outlook is expected to warrant higher interest rates over time, some continued monetary policy accommodation will likely be needed to support growth and inflation. Some will worry that the BoC’s emphasis on foreign direct investment and trade will cause policymakers to lose their grip on inflation.

Elsewhere, the Bank of Japan also kept its key short-term interest rate unchanged at -0.1% at its March 2018 meeting, as expected. Policymakers also kept its 10-year government bond yield target around zero % and maintained its upbeat economic view ahead of the new term for Governor Haruhiko Kuroda.

CADJPY is one of the better candidates since recent CAD weakness has undershot recent moves in oil and rate spreads.

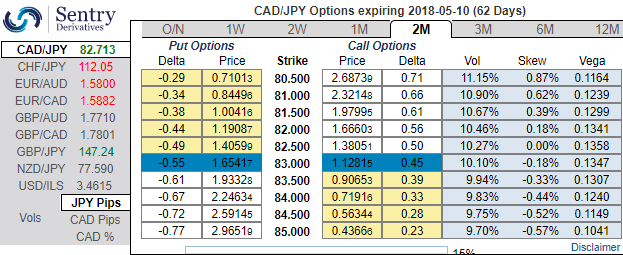

Well, please be noted that the positively skewed ATM IVs of 2m tenors indicate the hedging interests of OTM put strikes upto 80.50 levels.

Technically, we’ve already stated in our recent write-up that the current week prices tumbled well below 21EMA levels with flurry of bearish indications, such as shooting star candlestick patterns have broken wedge baseline with bearish DMA & MACD crossovers that signal the intensified bearish momentum and downtrend, thereby, one could expect more slumps as both the leading oscillators have been constantly converging downwards to signal weakness. In this process, CADJPY spot FX has tumbled from 91.581 to the current 82.461, more dips seem to be on cards (refer our post on the technical section for more reading).

Well, to factor-in all above stated driving forces, we reckon that the underlying pair has equal chances of moving on either side but with more potential on the downside, accordingly, we’ve already advocated options strips strategy in the past.

We continue to reiterate it is wise to initiate longs in 2 lots of 2m ATM -0.49 delta puts, simultaneously, add long in 1 lot of +0.51 delta call of the same expiry, the payoff function of the strategy is likely to derive positive cashflows regardless of swings but more potential from the underlying spot FX moves towards downside.

The risk is limited to the extent of premium paid to buy the options.

The reward is unlimited until the expiry of the option.

Please note that the trader can still make money even if he was wrong, that means the strategy likely to derive handsome yields in premiums regardless of swings. But the spot FX has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying shy above 94 levels (bearish), while hourly JPY spot index was at -109 (bearish) while articulating (at 06:36 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise