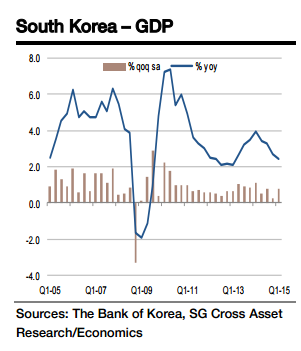

The release of advance GDP figures for Q2 2015 is basically set to be a non-event, as BoK Governor Lee Ju-yeol already disclosed a flash estimate of 0.4% qoq, at the press conference following the MPC meeting on 9 July. He attributed the significant slowdown in GDP growth to the MERS (Middle East Respiratory Syndrome) outbreak and the drought.

Growth in key components of Q2 GDP can be calculated using the H1 GDP growth forecasts in the BoK's macroeconomic outlook also announced on 9 July. Consumption is likely to have been the main driver of the GDP slowdown, with qoq growth falling from 0.6% in Q1 to zero in Q2, probably due to MERS concerns. Construction investment looks set to show still-healthy growth of 1.7% in Q2 after the volatile shifts of -7.8% in Q4 2014 and 7.4% in Q1 2015.

Facility investment is likely to have remained sluggish at 0.2% in Q1 and Q2, while both exports and imports of goods are set to show a pretty strong recovery of 1.3% and 1.1% each after the contraction in Q1. If these flash estimates are correct, we can conclude that the weakness in consumption overwhelmed the rebound in exports. In H2, the key thing to monitor will be whether the BoK's assumption of an instant recovery in consumption and the continued strength in exports proves to be correct or not.

BoK discloses dip in GDP growth due to MERS outbreak

Monday, July 20, 2015 1:19 AM UTC

Editor's Picks

- Market Data

Most Popular

PBOC Scraps FX Risk Reserves to Curb Rapid Yuan Appreciation

PBOC Scraps FX Risk Reserves to Curb Rapid Yuan Appreciation  Trump Offers U.S. Insurance and Naval Escort for Tankers as Strait of Hormuz Crisis Disrupts Global Oil Trade

Trump Offers U.S. Insurance and Naval Escort for Tankers as Strait of Hormuz Crisis Disrupts Global Oil Trade  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Fed Minutes Signal Steady Interest Rates but Hint at Potential Rate Hikes if Inflation Persists

Fed Minutes Signal Steady Interest Rates but Hint at Potential Rate Hikes if Inflation Persists  China Unveils New Five-Year Plan Focused on Tech Power, Economic Growth, and National Security

China Unveils New Five-Year Plan Focused on Tech Power, Economic Growth, and National Security  Japan Signals Openness to Gradual BOJ Rate Hikes as Deflation Era Ends

Japan Signals Openness to Gradual BOJ Rate Hikes as Deflation Era Ends  Australia’s Economy Accelerates in Q4 2025 as Household Spending and Government Investment Rise

Australia’s Economy Accelerates in Q4 2025 as Household Spending and Government Investment Rise  Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears

Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears  Japan Coalition Urges BOJ Independence as Sales Tax Cut Plan Advances

Japan Coalition Urges BOJ Independence as Sales Tax Cut Plan Advances