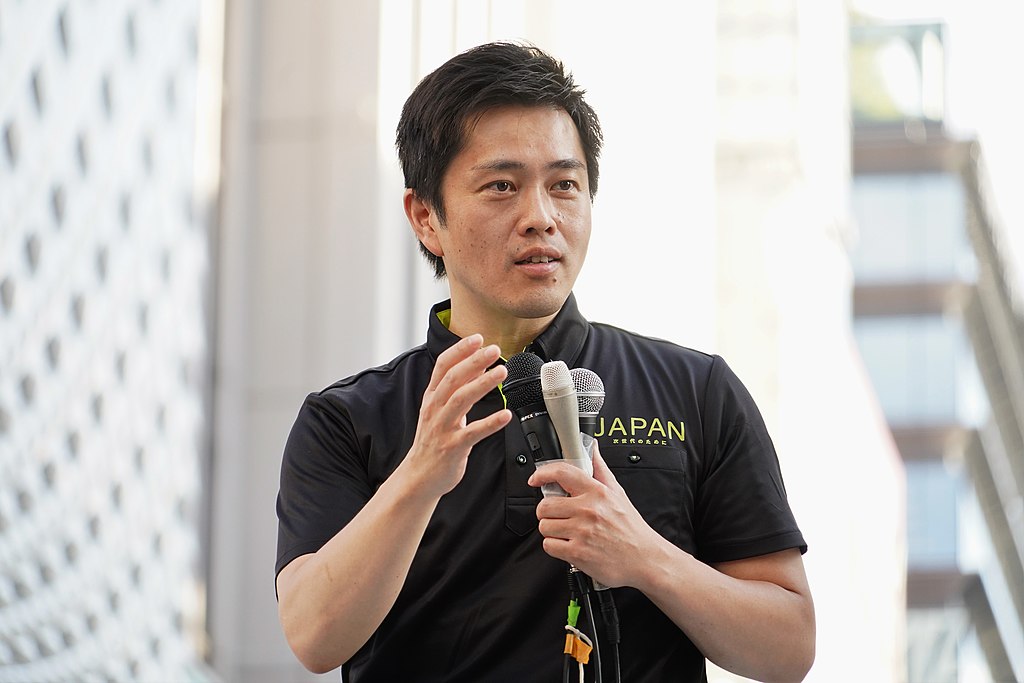

Japan’s ruling coalition is signaling a clear stance on monetary policy independence while advancing plans for fiscal stimulus to strengthen the economy. Hirofumi Yoshimura, leader of the Japan Innovation Party (Ishin) and junior partner in Prime Minister Sanae Takaichi’s coalition government, said the Bank of Japan (BOJ) must remain free from political interference as markets anticipate further interest rate hikes.

In a recent interview, Yoshimura stressed that decisions on Japan interest rates should be left to the BOJ, not politicians. He noted that while a potential rate hike could increase mortgage rates and cause short-term pain, the central bank must act based on market conditions. With the yen’s recent weakness, a rate increase remains possible. The Japanese government, he said, should instead focus on economic policies that help the country absorb the impact of tighter monetary policy.

Japan’s weak yen has become a major market concern, influencing inflation and raising import costs. Although a softer currency benefits exporters, it pressures households facing higher living expenses. The dollar recently traded at 152.66 yen after posting its biggest weekly gain since November 2024, intensifying speculation that the BOJ could raise rates again by April.

Alongside monetary policy discussions, the government is pushing forward a proposed two-year suspension of the 8% sales tax on food, currently lower than the 10% consumption tax applied to other goods. Takaichi has pledged to implement the measure during fiscal 2026 to ease the burden of rising living costs. Yoshimura emphasized the need to introduce the tax relief as early as possible.

To offset revenue losses without issuing new debt, officials are considering non-tax revenue sources, including potential use of Japan’s $1.4 trillion foreign exchange reserves. The move reflects the coalition’s broader strategy to balance fiscal stimulus with financial stability, while allowing the BOJ to independently manage interest rate policy amid ongoing currency market volatility.

Treasury Secretary Scott Bessent Slams JPMorgan Report on Gulf Oil Insurance as ‘Completely Irresponsible’

Treasury Secretary Scott Bessent Slams JPMorgan Report on Gulf Oil Insurance as ‘Completely Irresponsible’  U.S. Says Iran War Goals Unchanged as Operation Epic Fury Targets Missile and Naval Capabilities

U.S. Says Iran War Goals Unchanged as Operation Epic Fury Targets Missile and Naval Capabilities  China Unveils New Five-Year Plan Focused on Tech Power, Economic Growth, and National Security

China Unveils New Five-Year Plan Focused on Tech Power, Economic Growth, and National Security  Asian Stocks Rebound as KOSPI Surges, China Signals Stimulus Amid Global Tensions

Asian Stocks Rebound as KOSPI Surges, China Signals Stimulus Amid Global Tensions  Shell Signs Oil and Gas Agreements With Venezuela to Advance Dragon Gas Project

Shell Signs Oil and Gas Agreements With Venezuela to Advance Dragon Gas Project  Dollar Hits Three-Month High as Middle East Conflict Drives Energy Prices and Market Volatility

Dollar Hits Three-Month High as Middle East Conflict Drives Energy Prices and Market Volatility  Japan Seeks U.S. Tariff Exemption as Trade Tensions Lift USD/JPY

Japan Seeks U.S. Tariff Exemption as Trade Tensions Lift USD/JPY  PBOC Scraps FX Risk Reserves to Curb Rapid Yuan Appreciation

PBOC Scraps FX Risk Reserves to Curb Rapid Yuan Appreciation  Trump Praises Delcy Rodríguez as Venezuela Oil Exports Resume

Trump Praises Delcy Rodríguez as Venezuela Oil Exports Resume  ICE Arrests Colombian Journalist in Tennessee, Trump Administration Says She Will Receive Due Process

ICE Arrests Colombian Journalist in Tennessee, Trump Administration Says She Will Receive Due Process  BOJ Rate Hike in March? Yen Weakness and U.S.-Japan Summit Add Pressure

BOJ Rate Hike in March? Yen Weakness and U.S.-Japan Summit Add Pressure  Oil Prices Surge as Middle East Conflict Disrupts Global Supply

Oil Prices Surge as Middle East Conflict Disrupts Global Supply  Trump Demands Iran’s “Unconditional Surrender” as Israel-Iran War Intensifies Across Middle East

Trump Demands Iran’s “Unconditional Surrender” as Israel-Iran War Intensifies Across Middle East  Fed Minutes Signal Steady Interest Rates but Hint at Potential Rate Hikes if Inflation Persists

Fed Minutes Signal Steady Interest Rates but Hint at Potential Rate Hikes if Inflation Persists  Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears

Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears