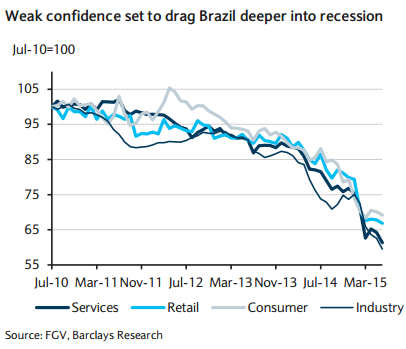

Brazil's economy is still facing a challenging outlook. Even though the industrial production index rose by 0.6% m/m sa in May, the trend remains fragile. Headline growth was driven by non-durable consumption and capital goods production, but auto intermediate goods production was negative. May's positive growth will prove fleeting as all leading indicators remain fairly weak, especially business confidence, which continues to drop to historically low levels.

Moreover, the outlook for the automotive sector remains fairly bleak, and the preliminary forecast for June industrial production is a drop of 1.2% m/m sa. Consumption, meanwhile, keeps falling. Retail sales contracted by 0.9 m/m sa and -4.5% y/y mainly on declining sales in the supermarket, furniture, auto, and construction material categories. The broad retail sales index posted an even larger contraction, of 1.8% m/m sa. A retail sales recovery does not look imminent - labor market deterioration should continue for the next few quarters, and the fall in real disposable income this year is expected to drive household consumption to contract by 1.2% in 2015. Moreover, consumer sentiment remains in the doldrums, and the tightening of monetary conditions does not support the credit market.

"We see strong downside risks to our Q2 real GDP forecast of -0.7% q/q sa. Furthermore, we see a risk that the drag carried through to Q3 will be larger than we anticipated: we forecast a 0.4% contraction in Q3, but leading indicators so far suggest a potentially larger contraction. Our current GDP growth forecast for 2015 is -1.1%," says Barclays.

Brazil: Confidence remains crucial to determine the outlook for growth

Friday, July 17, 2015 1:44 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed