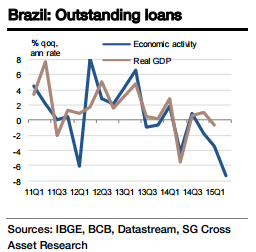

Brazil's economic activity index suggests that the supply-side economy contracted -7.3% qoq (annualised ) or -3.1% yoy in Q2.

"This prompts to project Q2 GDP growth of -1.7% qoq (-7.0% annualised or -2.7% yoy for the non-seasonally adjusted series), which is not significantly different from the earlier forecast. Yet, the economy seems to be heading for a worse contraction than it was expected until just a couple of months back. Both private and public consumption look in worse shape with the anticipated and significant fiscal drag from H2 and inflation set to continue to rise", Societe Generale.

Moreover, data through Q2 show no evidence of investment bottoming despite some gains on the export front (in volume terms) - primarily due to the depreciating currency. The lagged effect of higher interest rates will continue to exert downward pressure on investment, particularly in the current environment where confidence is extremely low.

"Assuming the fiscal situation remains stressed and the unemployment rate continues to rise, the economy will contract -2.1% in 2015 followed by -0.1% in 2016. The only upside, at this stage, could be a potential revival through trade channels. However, we are hesitant to take big bets on this as of yet", states SocGen.

Brazil GDP likely to contract heavily in Q2

Friday, August 28, 2015 6:08 AM UTC

Editor's Picks

- Market Data

Most Popular

USITC to Review Impact of Revoking China’s PNTR Status, Potentially Raising Tariffs on Chinese Imports

USITC to Review Impact of Revoking China’s PNTR Status, Potentially Raising Tariffs on Chinese Imports  Trump Touts Stock Market Gains and 401(k) Boost Amid Tariff Uncertainty

Trump Touts Stock Market Gains and 401(k) Boost Amid Tariff Uncertainty  Gold Prices Rally in February as Geopolitical Risks and Economic Uncertainty Boost Safe-Haven Demand

Gold Prices Rally in February as Geopolitical Risks and Economic Uncertainty Boost Safe-Haven Demand  Oil Prices Steady as US-Iran Nuclear Talks and Rising Crude Inventories Shape Market Outlook

Oil Prices Steady as US-Iran Nuclear Talks and Rising Crude Inventories Shape Market Outlook  Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit

Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit  U.S. Stocks Rally as Nvidia Earnings Loom, Oil Prices Near Seven-Month Highs

U.S. Stocks Rally as Nvidia Earnings Loom, Oil Prices Near Seven-Month Highs  BOJ Signals Possible April Rate Hike as Ueda Eyes Inflation and Wage Growth Data

BOJ Signals Possible April Rate Hike as Ueda Eyes Inflation and Wage Growth Data  Ecuador Raises Tariffs on Colombian Imports to 50% Amid Border Security Dispute

Ecuador Raises Tariffs on Colombian Imports to 50% Amid Border Security Dispute  Gold Prices Rebound as U.S. Tariffs, Fed Policy and Iran Talks Drive Market Sentiment

Gold Prices Rebound as U.S. Tariffs, Fed Policy and Iran Talks Drive Market Sentiment