The CMN today reduced the inflation target range for 2017, a change in the monetary policy arrangement in Brazil aimed at increasing its effectiveness, in a context in which the BCB is hiking the interest rates and is focused on regaining credibility and anchoring inflation expectations.

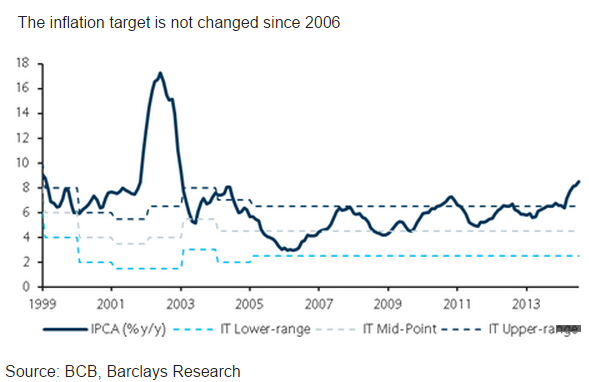

The National Monetary Council (CMN) announced this evening the 2017 inflation target, which will have as a mid-point 4.5%, with a tolerance range of +/- 1.5pp. This is the first time that the inflation target has been changed since 2006, and this is another move of the economic team aiming at regaining credibility.

By reducing the tolerance range, the BCB is emphasizing its commitment to the inflation target regime and signaling that it will need to be continuously vigilant to assure that actual inflation by 2017 stays within the range. It is a welcome and positive step amid the current juncture of recession, high inflation, high interest rates and fiscal consolidation.

For 2016 the inflation target is reaffirmed at 4.5%, with a tolerance range of +/- 2.0pp. The necessary effort to anchor, with no change in the target for the next year and the strong commitment of the Copom to the 4.5% mid-point, the Selic rate is expected to be hiked 50bp in July and very likely 25bp in September, with the latter decision being fairly data dependent on inflation expectations, actual inflation and the BRL.

Finally, the TJLP rate was increased to 6.5% for next quarter, from 6.0%. This is the interest rate that benchmarks the subsidized credit operations by BNDES, and by continually increasing it, the economic team aims to improve the transmission power of monetary policy to inflation.

It is believed that the TJLP will continue to be hiked throughout the year, even after the Copom ends the tightening cycle, reducing the gap of it to the Selic rate, in order to increase the effectiveness of monetary policy and give further support to Copom's task of keeping inflation within the target range for the next three years.

Brazil trimming the inflation target range

Friday, June 26, 2015 12:14 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed