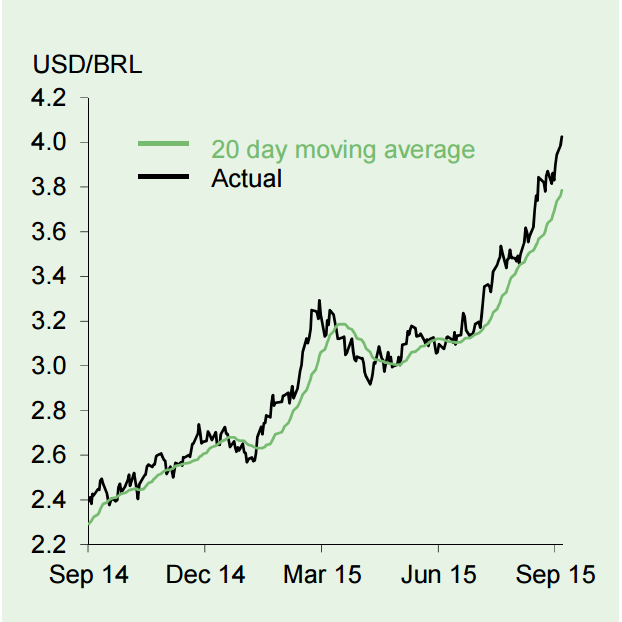

Over the past month the Brazilian real has retained the title of worst performing EM currency in 2015. The speed at which S&P downgraded Brazil to sub-investment grade and the retention of a negative outlook helped push the Brazilian real above its previous all-time October 2002 low of 4.004 against the USD.

Government plans to balance spending and avoid a downgrade from the two other major credit agencies lack credibility. This increases the likelihood that portfolio outflows will further pressurise the real over the next year. What Brazil's central bank can do to counter any further weakness appears limited.

The policy rate has likely peaked at 14. 25% and an increase in the $100bn swap programme looks untenable, after reports that the central bank has already booked a loss of R57bn this year by engaging in such operations. Meanwhile, August CPI printed at 9.5%, well above the 6.5% target. For now continued recession looks like the only hope of bringing inflation back to target, but probably only after further exchange rate depreciation.

Brazilian Real review

Thursday, September 24, 2015 12:32 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022