Brazil's shrinking domestic demand as the outlook for real exports has not deteriorated in the last few quarters, might be the cause of the recent contraction, more particularly, it has not done so since the sharp depreciation of the BRL this year.

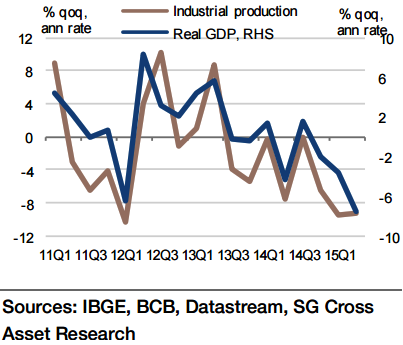

This current pace of IP contraction is nearly consistent with the supply-side economy contracting by between 2.5 to 3.0%. There is some downside to the current 2015 growth forecast of - 2.5%. Also, the IP contraction pace hints a further downside risk to 2016 outlook.

"Brazil's September IP likely falling 9.5% yoy, total production likely declined 9.1% yoy in Q3 and 7.2% yoy YTD. Aniticiparting no changes in the pace of decline in Q4, a total decline of 7.7% is likely to be seen in industrial production for 2015", says Societe Generale.

IP, declined by 3.2% in 2014 after printing a slow 2.1% growth in 2013. The manufacturing sector's lack of competitiveness, weaker growth in trading partner countries and the declining domestic demand have all contributed to the fall.

The BRL dropped heavily over the past few quarters and still continues, it is not yet clear if the exports and industrial production can be lifted by the currency depreciation alone in the near term, although it certainly has improved export competitiveness, which could potentially revive the Brazilian manufacturing sector.

The external demand situation is difficult. Moreover, a change of investment in the manufacturing sector will only be possible over the longer run because of the prevailing bottlenecks.

Brazil's IP likely in a falling pace through 2015-16

Wednesday, November 4, 2015 5:58 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX