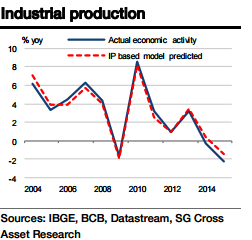

Assuming the same IP rate sustains as per first four months for the rest of the year, Brazil's supply side economic activity index should fall by -1.5% in 2015. However, year-to-date economic activity has collapsed slightly more than predicted by the model and continues to add to the downside risks to our growth forecast although economy might do slightly better in H2.

"Given the trends in trade and the initial survey-based releases, IP is expected to decline by -6.8% yoy in May leaving the year-to-date collapse unchanged at 6.4%. IP is expected to post yet another significant decline in May (-0.7% mom). These numbers are broadly in line with the Q2 growth estimate of -7.9% qoq (at an annualized rate)", forecats Societe Generale.

Given these sequential growth rates, IP growth in Q2 could be worse than in Q1 on sequential and seasonally-adjusted terms. Industrial production declined by 3.2% in 2014 after modest growth of 2.1% in 2013. This was mainly the result of the manufacturing sector's lack of competitiveness (reflected in Brazil's falling external balance) and, more recently, falling domestic demand.

While the BRL has depreciated significantly over the past few quarters not withstanding recent appreciation, further heavy depreciation is probably the only realistic way to improve competitiveness in the medium term and revive Brazilian manufacturing.

Brazil's Industrial production to fall at substantial pace in Q2

Thursday, July 2, 2015 5:12 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed