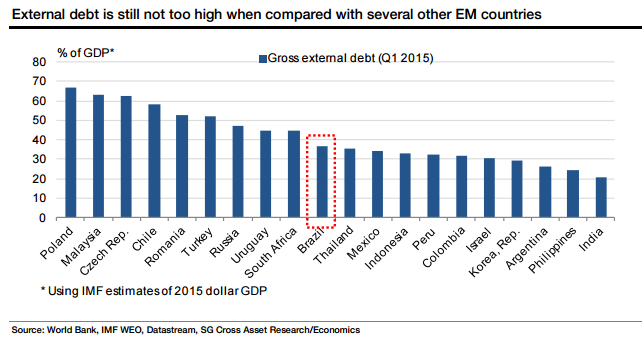

Brazil's external debt (ED) to GDP ratio - which declined to nearly 17% of GDP in 2008 and still stood at a moderate 25.2% at the end of 2013 - rose to 41% of GDP in Q3 15. While the increase in 2014 was driven by a rise in external borrowing, the recent increase in the ratio has been driven purely by the depreciation in the BRL that led to a contraction in dollar GDP. With the USD to BRL exchange rate expected to stay close to USD1= in Q4 15, the ED to GDP ratio is expected to rise to 45% of GDP this year.

Despite this significant increase, Brazil's ED to GDP ratio remains fairly comparable to that of most EM countries, including some Latam countries (Chile in particular). Furthermore, when looked at in isolation, it seems that the ED to GDP ratio itself is not all that threatening. Rather, it is Brazil's macro and financial situation that is responsible for the discomfort with the current level of ED to GDP ratio.

Brazil’s external debt is not among the worst in the EM world

Wednesday, September 30, 2015 8:53 PM UTC

Editor's Picks

- Market Data

Most Popular

Federal Judge Orders Refund of Trump’s Emergency Tariffs, Potentially Returning Up to $182 Billion

Federal Judge Orders Refund of Trump’s Emergency Tariffs, Potentially Returning Up to $182 Billion  U.S. Stocks Fall as Middle East Conflict Fuels Inflation and Oil Price Concerns

U.S. Stocks Fall as Middle East Conflict Fuels Inflation and Oil Price Concerns  Australia’s Economy Accelerates in Q4 2025 as Household Spending and Government Investment Rise

Australia’s Economy Accelerates in Q4 2025 as Household Spending and Government Investment Rise  China Sets 2026 Growth Target at 4.5–5% While Prioritizing Innovation and Industrial Strength

China Sets 2026 Growth Target at 4.5–5% While Prioritizing Innovation and Industrial Strength  Dollar Hits Three-Month High as Middle East Conflict Drives Energy Prices and Market Volatility

Dollar Hits Three-Month High as Middle East Conflict Drives Energy Prices and Market Volatility  Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears

Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Australia and Canada Strengthen Critical Minerals Partnership Through New G7 Alliance Agreements

Australia and Canada Strengthen Critical Minerals Partnership Through New G7 Alliance Agreements  Japan’s Rengo Unions Seek Nearly 6% Wage Increase in 2026 Labor Talks

Japan’s Rengo Unions Seek Nearly 6% Wage Increase in 2026 Labor Talks