Global sovereign bond market seeing massive selloffs as investors rush for exit from crowded one sided trade. Though this recent rout tends to be global phenomenon, European bonds are experiencing most of the brunt amid heavy price swings.

- German Bund, which stands as European monetary union's benchmark debt, has surged to 0.61% as of now from its historic low of 0.05% on April 17th.

- German yield curve that moved to negative territory, up to 9 years is now negative only up to 4 years.

- German 30 year rose from 0.41% on April 17th to 1.195% as of today. This is close to 78 basis points rise in just a matter of two weeks.

Legendary bond investor Mr. Bill Gross has warned against one way move to bring rates close to negative territory and thought of it as historic opportunity to short 10 year bund. However market moved even before he could take position according to his say, resulting in loss in his long bund positions.

This column has been warning against one way ride in sovereign bond market and lending to government at near zero rates.

However we did not consider bund as historic opportunity to go short, we preferred French counterpart and still maintain the stance and believe that lending to government even at this rate doesn't make sense and believe that central bank's monetary policy might get to successful in bringing back inflation.

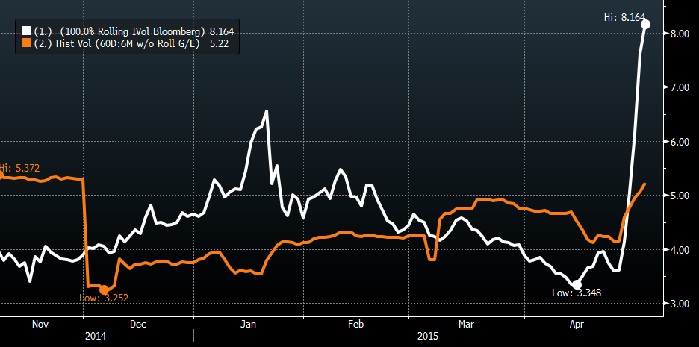

The price rout came with higher volatility and price swings, posing additional problems for market participants.

- The chart from Bloomberg shows that implied volatility has reached 8.16% from just 3.3% in mid -April. Volatility has reached highest level since 2012.

Inflation expectation and rising fuel price might be contributing to latest rout in bond market, we believe lack of liquidity in the market and rush to exit is responsible for such price swings.

Reaction from ECB, over this latest rout would be vital to watch out, however ECB might shrug off any fear and taper talks as 10 year bund yield at 0.61% is still very low.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary