The Central Bank of the Republic of China (Taiwan) (CBC) is expected to trim its key policy rate at the monetary policy meeting scheduled to be held on Sep 29 as benign inflation outlook laid the bedrock for further easing.

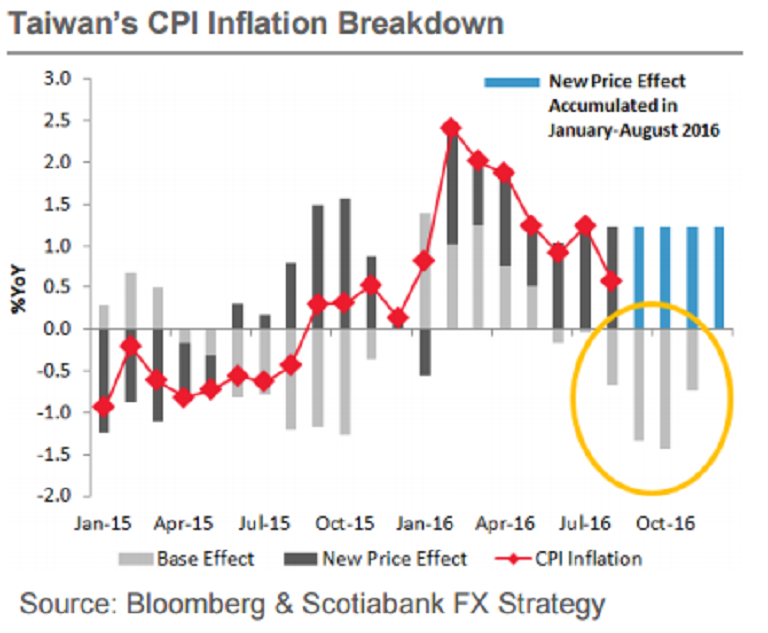

Taiwan’s CPI inflation dropped to 0.57 percent y/y in August after accelerating to 1.23 percent the prior month, primarily due to a negative base effect. The headline retail inflation is expected to stay soft in the months ahead before rebounding somewhat in December. In addition, persistently low auction yield on the 364-day NCD may signal the prospect of further rate cuts, Scotiabank reported.

Meanwhile, Taiwan sees some early signs of economic recovery. The island's export orders surged 8.3 percent y/y in August, thanks to booming demand for handsets and other electronic products after falling for 16 straight months. In addition, its industrial production jumped 7.74 percent y/y last month after declining 0.36 percent y/y in July, beating market estimate of a 4.00 percent rise.

"However, we think another rate cut is needed to further shore up the economy and September quarterly MPC meeting is a proper timing," the bank commented in its latest research report.

A survey by National Central University released on Tuesday showed that consumer confidence weakened 0.9 points to 78.66 in September from a month ago. Meanwhile, on the FX side, the TWD has been running a tight correlation with local shares since early 2015 and will remain susceptible to the news headlines on the US presidential debates/election, Fed speeches and US economic data in the weeks ahead.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom