As Russia was the earliest of a group of commodity-oriented emerging market economies to abandon the peg, the current turmoil has not surprised Russian markets, neither has the spike in the rouble's volatility, which has risen to the level seen in May 2015, although it is still far from the elevated level of January 2015.

This time, the central bank of Russia (the CBR) is staying on the sidelines, resisting FX or even verbal intervention in order to avoid the risk of losing credibility.

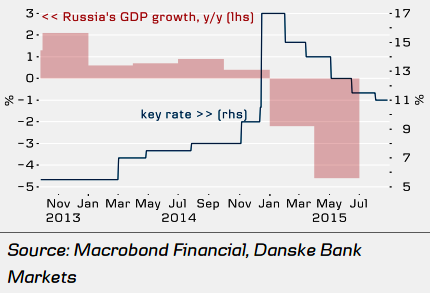

"The renewed fall of the rouble will halt CPI growth deceleration and may push consumer prices further in the short run. Thus, the CBR is expected to halt its rate cuts on 11 September", says Danske Bank.

However, possible price increases will not be as dramatic as in early 2015, when the December 2014 devaluation was transferred into consumer prices. During 2015, the CBR has been consistent in its monetary policy, cutting its key rate by 600bp YTD as consumer price growth slowed and inflation expectations have eased on a stabilised rouble, after peaking at 16.9% y/y in March 2015.

"The CPI is expected to post 11% y/y in December 2015 on a high base effect and falling economic activity", added Danske Bank.

CBR set to halt monetary easing

Thursday, August 27, 2015 4:19 AM UTC

Editor's Picks

- Market Data

Most Popular

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook