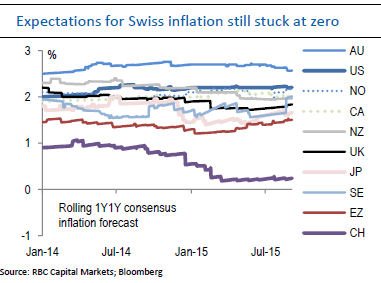

The driving factor behind the long-term CHF view is Switzerland's inflation outlook which will allow the SNB to keep its nominal rates lowest in the world. While its real rates are amongst the highest in G10, it is observed before that nominal rates are more important in driving spot FX returns.

The above figure shows updated 1Y1Y consensus expectations (year ahead inflation, 12 months out). By 2016, Switzerland is expected to be the only G10 country with inflation still hugging zero.

The SNB does not expect inflation to turn positive until early 2017 and it expects to keep rates at -0.75% throughout the forecast horizon. An extension to ECB QE in Sept 2016 is expected which should flatten the path for EUR/CHF next year, says RBC Capital Markets.

CHF monthly currency outlook (6 – 12 month)

Thursday, October 8, 2015 11:31 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed