China announces biggest adjustment to CNY fixing on record, moving the USDCNY fixing higher by 1.9%, in what the PBoC noted as a one-off adjustment.

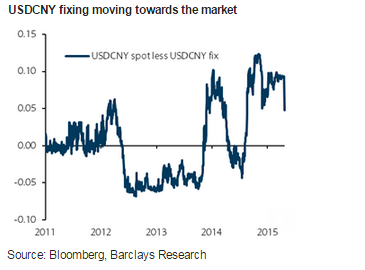

The PBoC highlighted that the "yuan exchange rate has deviated from market expectation" reflecting the fact that prior to the fixing adjustment USDCNY was trading around 1.5% above the mid rate, moving to around half of that after the adjustment in the fixing. The adjustment in the fixing is seen as a deliberate attempt to align the fixing with the market, which marks a further step towards liberalising the FX market, says Barclays.

The PBoC announced this morning a move to improve the pricing mechanism of the daily fixing rate, with a reference to the previous day's closing rate, as well as taking into account FX market supply-demand and major global currency movements.

According to Barclays, this new pricing mechanism, if followed through, marks a revolutionary move towards improving the CNY exchange rate formation mechanism. The CNY exchange rate has been anchored by the daily fixing rate and a daily trading band. While the trading band has been widened a few times, the daily fixing rate has consistently deviated from the market-determined spot exchange rate, raising questions of government intervention.

This sharp adjustment of the fixing was noted as a one off move, the shift in determination of the mid point towards a more market-based expectation highlights that the sharp deviation of market USDCNY expectations versus the fixing should now narrow on a more sustainable basis. While the PBoC will likely still not wholly transfer determination of the currency to the market, it is a major step in in that direction.

"However, if there are sharp moves on a day-to-day basis we would expect the authorities to step in and prevent sharp moves in the fixing, even if the market was implying a bigger move", states Barclays.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022